COVID-19 has resulted in a need to accelerate the transformation of many asset finance company systems environments.

Systems providers have been extremely active innovating and bringing new functionality and new solutions to market in recent years and months.

New demands continue to arise, and new solution opportunities are emerging continuously providing even more aspects for businesses to assess and evaluate.

Experience of failed deployments and costly over-runs in many asset finance company systems implementations generate a sense of anxiety when it comes to systems selection.

In order to help clients move through the system choice process with greater confidence, Invigors has developed a proven methodology and approach which has resulted in many successful client systems migrations.

Change management & acceptance

One of the main learnings that has come out of years of practising transformation in Leasing businesses is that the effectiveness of a solution is a factor of two things:

- the “Quality” of the solution that is implemented; and

- the “Acceptance” by the business of the new solution that replaces the familiar, adapted tool that the business has built its practices around.

Tried and tested Change Management techniques use the well-known formula Q x A = E. If Quality & Acceptance are measured on a scale of 1 to 10, Effectiveness is scored out of 100 which is a multiple of the two. A tool with perfect Quality (10/10) which attracts low Acceptance (2/10) will only be 20% effective. But a good tool (8/10) well implemented (9/10) will be many times better.

Assessing the tool & the provider itself is undoubtedly important. The same weight needs to be given to the implementation path and the ease with which the tool and the project are assimilated into a business. In our experience this is crucial. It allows the business to avoid projects being derailed by resistant users. (Of which there will always be some and often many).

Poor initial experience can lead to reputational damage which can be challenging to recover from.

Provider assessments

Some of the main considerations for assessing a provider and its tool are highlighted below: these are familiar to all, and a foundational part of the analysis:

- Capabilities and Functional Fit: How does the solution match with the current known business requirements and how does it map to the likely future business needs? How does the solution address current and potentially new go-to-market models? Does the solution address the needs of as a service and pay per use with the complexity of multi-party data integration and variability in billing? Will the initial functionality suffice, and will the business needs evolve during the course of deployment and how can the solution evolve and flex?

- Technical Fit: To what extent does the solution fulfil the current and expected known future non-functional requirements (e.g. Ability to integrate with third-party systems, cloud readiness, security and data strategy etc., technical IT internal resource requirements and staffing needed for migration and integration with the existing systems and apps ecosystem, is the technology stack fit for the future?)

- Operational Fit: To what extent does the solution meet the need of the internal operations functions? Is this solution easy to grasp and efficient to use? Are there effective controls and workflow available and easy oversight for management? How is the user experience for end customers, dealers, suppliers etc.? Does the solution support local business requirements without costly and lengthy customization / adaptation?

- Implementation Path: Linked to the operational fit is the ease with which the provider can adapt any solution to the business to gain technical acceptance. This involves characterising the gap between the current state of a client’s infrastructure the to-be desired state, and developing a clear path from A to B. This also requires the successful migration of portfolios;

- Supplier Fit: What are the strengths and the weaknesses of the supplier? What is their pedigree and what is their experience to date in delivering and implementing such transformation? Does the supplier have the financial strength to deliver both in the short term and in the long run? Is there a solid vision and strategy towards platform evolution?

- Cost of Ownership and Management: What will be the likely all up cost of the transformation, i.e. not just the upfront investment of implementation and integration with other systems and all the associated costs of data conversion and migration etc., but also on-going costs of internal maintenance and on-going costs of external support and the ability to cost effectively upgrade to future versions? Does the business have the requisite internal skills and resources to manage the solution, or will additional staffing and skill sets be required?

In addition to these objective factors, we will urge a business to review the softer aspects as well. In our experience, alongside the rational questions that customers ask about all these objective evaluation criteria, the final and decisive factor is a human one. How well will the project team work together with the supplier? Is there a good cultural fit between the businesses that will foster a long term partnership?

- Implementation Concept & Team: What will be the pain of implementation for the client? Is there a route to multi-product or country implementation that allows an Agile, staged, ramp-up rather than a long waterfall project that only delivers after major customisations have been defined, specified and tested? This question goes to the heart of the challenges of many historic implementations where a business is replacing a tool that has been customised over decades.

Customising a market standard tool to all of those requirements can often generate significant deployment delays. And the business only really appropriates such a tool after a long project that sucks up huge resources. Some of the answers will relate to the adaptability of the tool. But a lot of this assessment can only be made when looking the supplier in the eyes and understanding how they will make the project a partnership.

- Cultural Fit: A strong cultural fit between two organisations can simplify the project, ensure easy resolution of the difficult challenges of an implementation which can feel like open heart surgery for a customer who has lived with the strengths and weaknesses of its own legacy system for many years.

The Invigors approach to Systems Selection

In order to perform this evaluation, we recommend therefore an objective, independent filtering of suppliers to the needs of the business through a shortlisting and evaluation, then face to face meetings of a selected shortlist to confront the cultures of the two organisations.

Clearly a supplier will need to tick the boxes and demonstrate it can deliver the needs laid out in an evaluation. But in many cases several suppliers score strongly in an RFI Matrix, and do not deliver on this most important aspect.

Short listing support

Our process to arrive at a shortlist will typically contain these key steps:

- High Level Requirements Scoping

- Preparation of a Supplier Evaluation Matrix

- Supplier Long-Listing

- Evaluation Against Shortlist

- Selection to Shortlist

- Initial face to face presentation of Shortlist

The objective and subjective selection process allows a first view of the Quality of the proposed solution and the elements of Acceptance that are dependent on external factors (the supplier, the implementation approach). This allows us to help the client to choose a limited number of players

RFI & Deep Dives

Then we organise demonstrations to assess the cultural fit, “look and feel” of the tool, prior to selecting a shortlist who will move forward on a more formal RFI for deep-dive feasibility studies.

To learn more about how Invigors can help accompany businesses through the selection and implementation process, please contact one of our consultants:

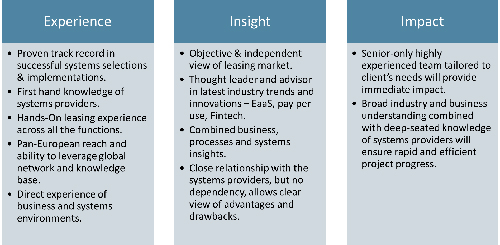

Why Invigors?

Ian Robertson and Paul Johnson-Ferguson are executive directors at Invigors EMEA Ltd