How finance can help to drive the SME transition to Net Zero

The UK’s 1.4 million SME employers[1] are required to play an essential part in meeting the Government’s 2050 Net Zero target[2]. The financial services association, UK Finance, notes that, although they individually have a relatively small environmental footprints, SMEs collectively account for 43-53% of UK business emissions.[3] It is clear that small and medium-sized businesses need to do their bit to help reduce the overall scale of emissions – and not just to meet incoming compliance guidelines.

For many SMEs, investing in the strategies, infrastructure and technology to help reduce emissions can seem prohibitively expensive or complex. However, with the right kind of financing in place, these businesses can position themselves to meet both sustainability and business goals, starting with small-scale projects that have a large-scale impact.

What’s holding up sustainability among SMEs?

Unsurprisingly, most of the obstacles to increased SME sustainability are financial. Even with the best intentions it can be hard to overlook the bottom line. In June 2024, NatWest’s quarterly Sustainable Business Tracker found that 36% of small and medium-sized enterprises intend to prioritise climate action over the next 12 months, down from 44% when the survey first began in 2020.[4]

Rising business costs are the biggest reported obstacle to improving sustainability performance.[5] A separate report from UK Finance confirms that almost half (48%) of small business owners are worried about the impact of increased costs and economic conditions on their businesses, rising to 57% among those who want to reduce their climate impacts.[6]

These pressures are restricting investment into renewable assets – even though they end up saving the company money. Confidence to invest in sustainability improvements is low. The lack of a clear and consistent policy framework is also proving problematic; as one study puts it, “Establishing clear and consistent policies is crucial for providing organisations with a tailored and stable framework to plan and implement their net zero strategies” [7]. However, despite these obstacles, many SMEs remain determined to prioritise sustainability.

How can private finance help?

There are grants and other incentives available to SMEs looking to make progress on their sustainability journey.[8] The government’s Business Finance Support hub provides a comprehensive list of available funding,[9] while the UK Business Climate Hub was launched in 2024 to provide SMEs with “carbon-cutting advice” in one place, as well as access to financing and support.[10]

However, no small business can make a convincing business case based on grants. The return on investment has to stand up on its own merits, and incentives and grants simply act as an additional accelerant for investment. Access to private, flexible financing that can spread capital costs over several years is a critical part of most SME’s business cases. It brings costs and revenues into alignment, making investment affordable.

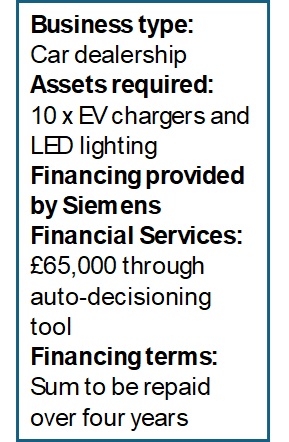

Such solutions are also particularly useful to introducers who can leverage flexible finance at point-of-sale so that customers can go ahead and invest in an affordable way. Introducers can work with knowledgeable financiers like Siemens Financial Services to design lease structures that form a compelling part of their value proposition.

How can SMEs make their first sustainability steps?

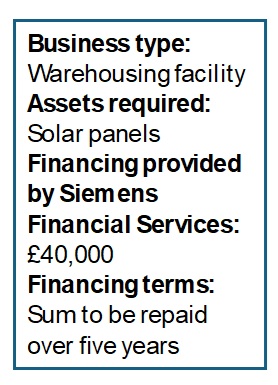

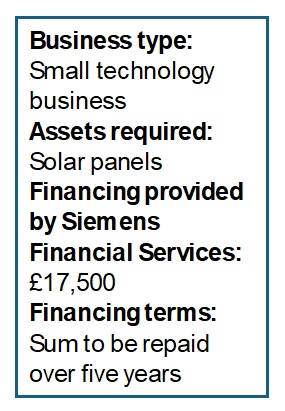

‘Small-ticket’ investments (anything under £500,000), such as solar panels, LED lights or electric vehicle chargers, can significantly cut down footprint – while also cutting costs. An experienced financier with efficient digital tools in place can help businesses invest in these assets quickly, and can approve financing without lengthy and complex conversations – thanks to their knowledge of the assets in question. .

Of course, for those larger and more ambitious projects, the financier should then be able to draw on its expertise to create a more tailored proposition

Solar panels

Given rising energy costs in recent years, solar panels have become even more attractive as a means of energy self-sufficiency. As one commentator notes, the upfront costs of commercial solar installations “can range from £15,000 to £29,000 for a typical system size required by small to medium-sized businesses…the payback period often falls between 6 to 8 years. After this, the energy generated is essentially free, barring maintenance costs, which are typically low.”[11]

LED lighting & HVAC systems

Another ‘small-ticket’ area where powerful savings could be made is through energy-saving assets such as LED lighting and heating and cooling systems. And financing options such as energy performance contracting agreements, which spread payments over an agreed term to align with guaranteed savings, effectively make the investment net zero cost.

As part of a smart building, incorporating features such as occupancy tracking, air quality monitoring and asset tagging can also save energy. The built environment contributes to around 25% of the UK’s carbon footprint[12], so wider uptake of energy efficiency initiatives could make a serious dent in emissions.

Electric vehicles & charging infrastructure

For businesses with a fleet of vehicles, or businesses where employees often bring their car to company premises, electrification can bring further sustainability and commercial benefits. Fleet and business demand for electric vehicles (EVs) has risen at a faster pace than consumer interest[13] – driven by both environmental considerations and car policy changes – but the upfront costs may be slowing down further uptake.

As PwC notes, “electric vehicles typically cost more to buy but are less costly to operate than diesel”[14]. The analyst therefore suggests different payment structures, where investors “could finance the upfront capital required, allowing fleet operators to focus on their core operations whilst speeding up the transition to decarbonise our roads… Whether it’s payments per mile or per day, this turns the outlay into operational rather than capital cost and makes the sums more manageable for the fleet operator.”

A parallel concern is that, currently, available public EV chargers as a proportion of the EV fleet is only 3.7%[15]. Providing EV charging onsite at work supports the EV rollout and makes an important contribution to reduced transport emissions.

Bridging the sustainability investment gap

It’s crucial that businesses explore both public and private funding options, even if there is a reluctance to reach outside their immediate means. Private sector financing solutions can help bridge the gap between what a business can invest and what is needed to achieve meaningful returns. In the long run, this can produce extraordinary sustainability and financial results.

Click here to find out more about how flexible finance options are helping SMEs to drive sustainability in the UK.

Notes:

[1] https://www.gov.uk/government/statistics/business-population-estimates-2023/business-population-estimates-for-the-uk-and-regions-2023-statistical-release

[2] https://www.fsb.org.uk/knowledge/fsb-infohub/small-business-sustainability-hub.html

[3] https://www.ukfinance.org.uk/policy-and-guidance/reports-and-publications/unlocking-sme-net-zero-transition

[4] https://www.natwestgroup.com/news-and-insights/news-room/press-releases/economic-analysis/2024/jul/employment-growth-hits-four-month-high-despite-stalling-sme-reco.html

[5] https://www.natwestgroup.com/news-and-insights/news-room/press-releases/economic-analysis/2024/jan/natwest-sme-pmi-tracker.html#:~:text=Around%2060%25%20of%20the%20survey,31%25%20of%20SMEs%20in%20Q4.

[6] https://www.ukfinance.org.uk/system/files/2024-05/UK%20Finance%20SME%20sustainability%20report_0.pdf

[7] https://businessclimatehub.uk/wp-content/uploads/2024/09/2024-UK-Net-Zero-Business-Census-Report.pdf

[8]https://www.ukfinance.org.uk/system/files/2022-04/How-SMEs-can-Finance-their-Climate-Action_TandR.pdf

[9] https://www.gov.uk/business-finance-support

[10] https://businessclimatehub.uk/

[11] https://path.energy/news/how-much-do-business-solar-panels-save/#:~:text=This%20can%20majorly%20offset%20the,can%20also%20be%20quite%20compelling.

[12] https://www.pbctoday.co.uk/news/energy-news/how-smart-buildings-helping-built-environment-reduce-carbon-emissions/143358/

[13] https://fleetworld.co.uk/uks-millionth-ev-registered-in-january-as-fleet-demand-soars/

[14] https://www.pwc.co.uk/industries/real-estate-and-infrastructure/real-assets/investment-opportunity-electric-vehicle-fleet.html

[15] https://www.siemens.com/global/en/products/financing/whitepapers/whitepaper-financing-ev-charging-infrastructure.html