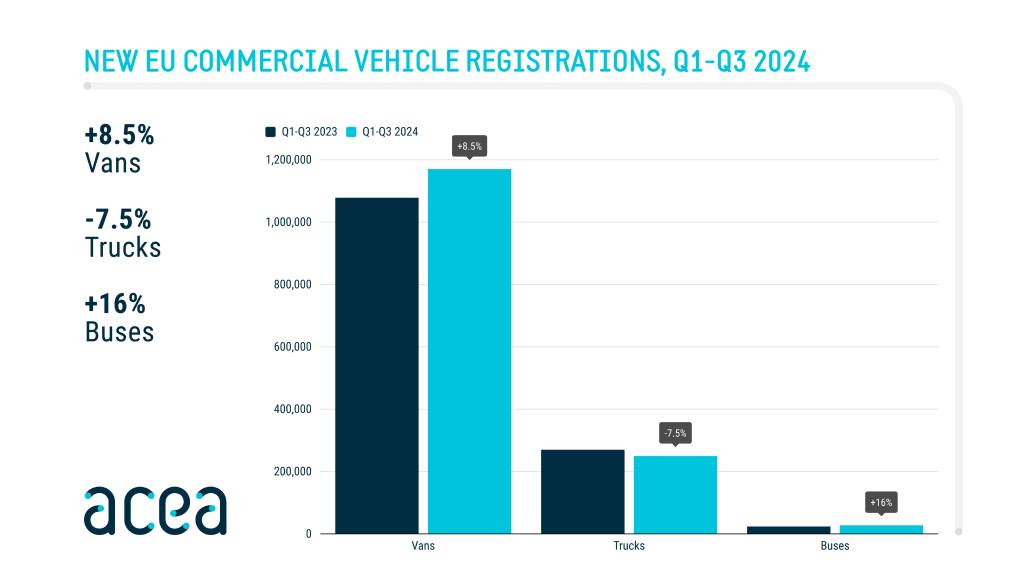

New commercial vehicle registrations in the European Union showed mixed trends during the first three quarters of 2024, with significant growth in van and bus sales offsetting a decline in truck registrations.

According to the European Automobile Manufacturers’ Association (ACEA), van sales rose by 8.5%, reaching over 1.17 million units, while bus registrations surged by 16%. However, truck sales fell by 7.5%, totalling just under 250,000 units from January to September.

EU van sales hit 1,170,310 units from January through September, buoyed by robust growth across all four major markets. Spain led the way with a 16.7% increase, followed by Germany (+8.2%), Italy (+7.3%), and France (+5.8%). The steady demand across these key markets underscores the strength of the van segment, which has seen renewed interest from industries reliant on last-mile logistics and other urban delivery services.

The truck segment experienced a challenging period, with registrations down by 7.5% to 249,708 units. The downturn was primarily driven by a sharp 9.5% decrease in heavy-truck sales. Medium truck sales grew slightly, with a 3% increase, though not enough to offset the losses seen in the larger vehicle category. Market trends varied significantly by country: while Spain and Italy posted gains of 12% and 2.1%, respectively, these were outweighed by declines in Germany (-7%) and France (-4.3%).

Bus registrations reached 27,400 units, a 16% increase over the same period last year. Electrically chargeable buses have gained momentum, with registrations up by 28.7%, pushing their market share to 15.9%. Germany emerged as the largest market for electric buses by volume, growing 11.4%, and Italy registered a remarkable 72.9% increase, making it the third-largest market. While diesel buses still command the majority at 66.6% of the market, their growth rate (19.4%) highlights the ongoing demand for conventional models in the sector.

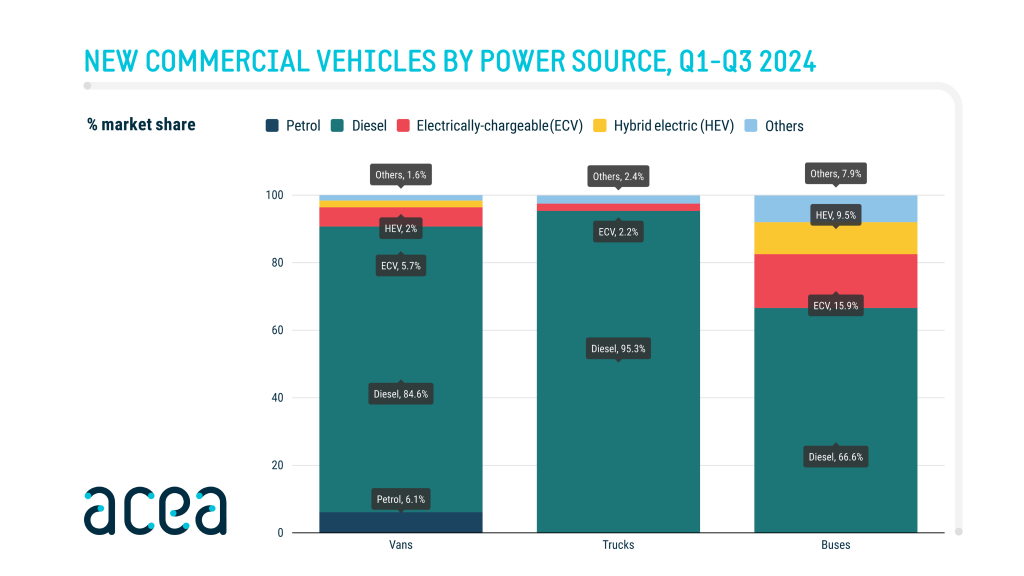

Market shifts by power source

Vans. Diesel-powered vans continue to dominate, accounting for 84.6% of the market with 989,975 units sold, an increase of 10.6%. Petrol models also rose modestly by 7.5%, capturing a 6.1% share. Electrically chargeable vans saw a significant drop of 12.8%, reducing their market share to 5.7%, down from 7.1% in 2023. Hybrid-electric vans similarly declined by 4.3%, now representing only 2% of the market.

Trucks. Diesel trucks maintained a robust 95.3% share of the market, despite a 7.3% year-over-year decline. Electrically chargeable truck registrations fell by 6.6%, holding steady at a 2.2% market share. Growth in electric truck sales in Germany (+56.8%) and Denmark (+22.3%) was unable to counterbalance losses in France (-58.4%) and the Netherlands (-52.7%).

Buses. Electrically chargeable buses continued to gain traction with a 28.7% increase, lifting their market share from 14.3% to 15.9%. Diesel buses, meanwhile, saw a 19.4% growth in registrations, boosting their share to 66.6%. Hybrid-electric bus sales dipped by 13.2%, reducing their share to 9.5%.