2018 will most likely end up being a more positive year than we might have expected – even considering the challenges around declining vehicle registration figures, WLTP, Bank of England interest rate increases and concerns over demand for diesel.

For me, none of these issues have been the most interesting aspect of the year; rather, it’s the year’s developments in regulation that continue to be the big story and have the most potential to shape our industry in the future.

June saw the Financial Conduct Authority (FCA) publish near final rules on the extension of the Senior Managers and Certification Regime to all regulated firms, including those within the motor industry.

This regime comes into force in December next year and extends the principle of prescribed responsibilities and the personal accountability of senior people beyond the current approved persons and much further into our businesses.

It will bring with it an extension of ‘fit and proper’ checks and the establishment of a public register of certified roles.

There are many aspects to this change that a firm needs to prepare for, including thinking about how it affects their business well in advance of the implementation deadline if they are to make the transition seamlessly.

Potentially even more significantly, the FCA is due to publish its full review of our sector this winter, following the update on its work on motor finance earlier this year.

What they told us in March was enough to let us know that the final report could have some far-reaching consequences across our industry.

The FCA’s final report is expected to focus on four areas: the culture of firms; affordability and how dealers and lenders make assessments; business to business (read ‘lender to dealer’) incentivisation and how it affects selling behaviour; and finally, the clarity and accuracy of point of sale information.

While we can be pleased with the progress our industry has made in these areas over recent years, only the complacent among us would claim the work is finished and I believe it is inevitable that the FCA will find areas where we could accelerate our rate of change.

2019 will be an interesting and busy year!

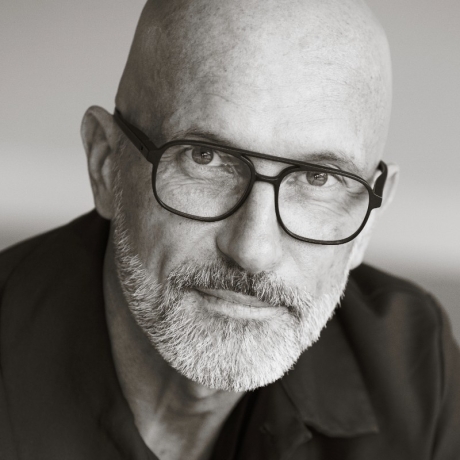

* Spencer Halil is director of Alphera Financial Services. Launched in 2006 as a subsidiary of the BMW Group, Alphera provides flexible finance, lease and insurance products through its nationwide network of official Alphera Partners – ranging from franchised dealers and groups to brokers and independent used-car retailers.