Summary

The recent AFC webcast, in association with Bynx, featured insights from Nick Brownrigg, former CEO of BMW Financial Services Nederland B.V. The discussion delved into the dynamics of the battery electric vehicle (BEV) market, particularly focusing on fleet demand, OEM strategies, and residual values.

BEV demand predominantly in the fleet sector

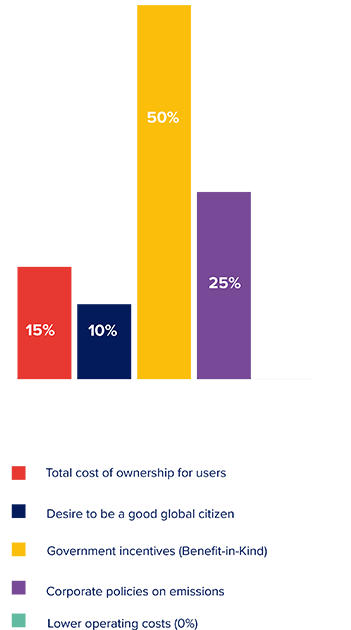

Brownrigg highlighted that incentives have been a major driver for the fleet sector’s adoption of BEVs, though not the sole factor. Tax-based incentives benefiting both employers and employees, such as reductions in benefit-in-kind and company car taxes, have been particularly effective in countries like the UK, Netherlands, Belgium, Italy, France, and Germany.

Brownrigg noted that, “Incentives have played a huge part, no doubt about that, but they are not the only answer as to why fleet has outpaced retail sales of EVs in recent years.”

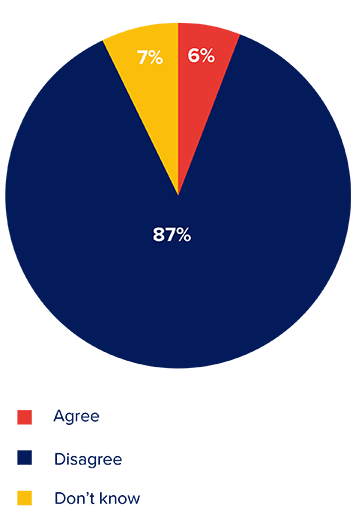

However, he noted the lack of consistency across the EU and the transient nature of these incentives, as illustrated by the drop in EV sales in Germany following the withdrawal of a purchasing incentive.

Brownrigg urged for incentives covering both fleet and consumer, and new and used EVs to be “in place until a change pattern has really formed that would, in turn, help the marketplace to settle and be clear on the transformation to electric”.

While fleet adoption has been partly driven by the desire to showcase green credentials, Brownrigg argued that rising energy costs and increasing depreciation rates have weakened the total cost of ownership argument for BEVs. Despite these challenges, ESG (Environmental, Social, and Governance) policies and brand positioning continue to motivate businesses to invest in EVs, with Brownrigg noting that having a zero-emission fleet strategy is key to the recruitment and retention of new talent.

The discussion also touched on regulatory influences and the need for more EU-wide policies to boost the mass market adoption of BEVs.

Role of OEM captives in the BEV market

Brownrigg discussed the evolving role of OEM captives, noting a new trend towards retaining vehicles on balance sheets and selling them through multiple cycles. Despite the potential benefits of this model, such as improved cash flow and leveraging telematics data, he observed that its implementation in Europe has been limited. The hesitancy is due to the financial risks and the complexity it introduces to balance sheets.

The agency model, undertaken by Mercedes-Benz, was mentioned as a potential catalyst for this shift. However, Brownrigg expressed scepticism about its widespread adoption. He emphasized the importance of connected cars and telematics data in optimizing vehicle lifecycles and maintaining residual values.

Residual values and market stability

The webcast addressed concerns about residual values (RVs) for BEVs, which have been volatile due to fluctuating market conditions and technological advancements. Brownrigg pointed out that higher BEV penetration in European markets, such as the Netherlands, has not necessarily led to more stable RVs.

Nick Brownrigg highlighted that, from 2035, all RV predictions for new vehicles will be EV based, removing the complexity of having to access RV risk against another purchasing alternative of petrol or diesel, for example, and therefore should bring more RV stability. But Brownrigg is quick to point out that this isn’t necessarily the case: “After that all the vagaries of crystal ball gazing remain – product lifecycle impact, battery technology, macro-economic factors, and the manufacturing supply of volume to the new car market.”

However, looking through rose-tinted glasses and from his recent experience in the market, Nick Brownrigg does believe that manufacturers have a much better understanding of the importance of residual management now than they had ten years ago.

“The importance of maintaining healthy residuals is a key factor of manufacturers today.”

Nick Brownrigg

Impact of Chinese brands in Europe

Nick Brownrigg believes that the entrance of Chinese EV brands into the European market will result in many more businesses and consumers driving EVs at an earlier point than otherwise would have happened.

“The competitive pressure coming from China to European manufacturers is forcing a hand that needed to be played anyway and it will accelerate the transformation towards electric,” Brownrigg observes.

But while the introduction of more affordable BEVs from Chinese manufacturers could increase market competition and accelerate EV adoption, Brownrigg warns that it could pose risks to RV management.

“While the entrance of Chinese EV brands is good from a transformational point of view, anything that accelerates transformation is usually a danger signal for residual value management,” he noted.

Concluding remarks

The webcast provided a comprehensive overview of the challenges and opportunities in the transition from ICE to BEV, with a particular focus on the fleet sector. Brownrigg’s insights underscored the importance of incentives, the strategic role of OEM captives, and the complexities of managing residual values.

While there are significant hurdles to overcome, the ongoing commitment to ESG principles and the evolving regulatory landscape suggest that the transition to electric mobility, though fraught with challenges, is well underway.