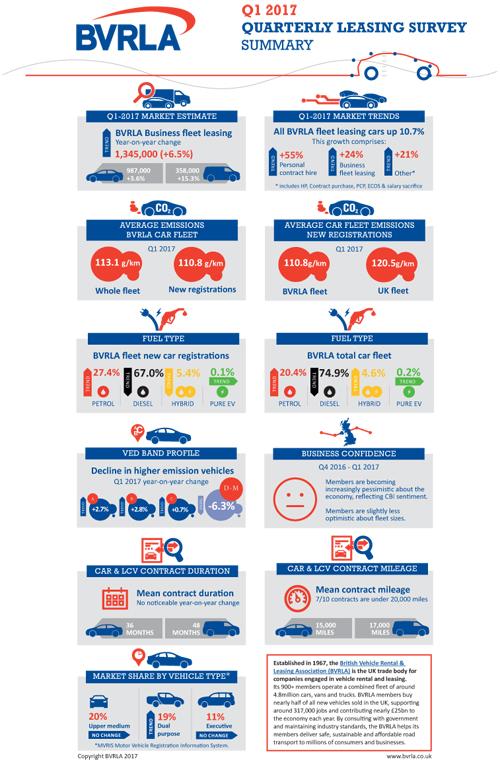

The total business fleet leasing market for cars and vans has grown 6.5% year-on-year to 1.345 million, with commercial vehicles accounting for most of the growth, new research reveals.

The British Vehicle Rental and Leasing Association’s latest quarterly survey found that the business car fleet grew just over 34,000 units (3.6%) to 987,000 vehicles between Q1 2016 and Q1 2017.

Despite accounting for a much smaller proportion of total leases, the light commercial vehicle fleet grew by more than 47,000 units (15.3%) to 358,000.

Growth in the leased van fleet comes despite the new commercial vehicle market slowing during 2017, which could indicate that more buyers are switching to leasing to guarantee their monthly costs and protect against unexpected swings in residual values.

Cost certainty has been a key driver behind the popularity of the car lease market for years, particularly in the business sector, although an increasing proportion of consumers are now opting for personal leases to fund their cars.

Total car leasing grew by 11% year-on-year with more than half of that growth coming from an increase in personal contract hire (PCH).

The research also found that although the proportion of diesel cars in the BVRLA fleet continues to decline, although it still accounts for most of the fleet and new registrations.

Around three-quarters of the BVRLA car fleet is now diesel (74.9% compared to 77.4% for the same period last year) and the fuel accounted for just over two-thirds of new registrations during the quarter (67% compared to 69.5% for the same period last year).

Diesel registrations are coming under pressure throughout Europe amid concerns that new legislation could increase taxes on the fuel and limit access to cities for older diesel models.

For example, in France, changes to tax rules on company cars aim to remove the historic financial benefits that diesel has enjoyed, while the government has moved to give petrol and diesel price parity at filling stations.

During the first half of 2017, 21% more petrol vehicles were registered to French companies than in the same period for the year previously.

Across Europe, nearly half of all new cars were diesel last year. In the EU15, diesel’s market share fell from 52.1% to 49.9% between 2015 and 2016. This drop was completely offset by an increase in the sales of petrol vehicles.

The BVRLA’s quarterly data showed its lease car fleet saw average CO2 emissions fall 4% year-on-year from 117.7g/km to 113.1g/km. In Q1 2017 the average emissions for new BVRLA member registrations was 110.8g/km CO2 compared with the national new registrations average of 120.5g/km. Both these figures remained static compared to the same period last year.

BVRLA chief executive Gerry Keaney said: “CO2 emissions are clearly heading in the right direction, but we are concerned with the lack of progress in the reduction of average CO2 emissions in new cars during 2016.

“Government has ambitious targets for improving air quality and cutting CO2 emissions. With the right tax regimes, incentives and guidance, the fleet industry can have a huge impact on achieving these goals.”