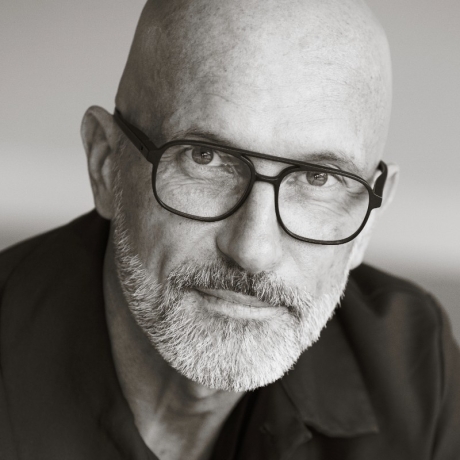

Hogan Lovells has announced that Alexander Premont will join the firm as a finance partner in the banking team. He will arrive on 5 May, working initially in London before moving to the Paris office at the end of August.

Premont joins from Linklaters in London. He is dual-qualified in French and English law with a principal focus on asset finance and in shipping and aviation finance in particular, as well as insurance financings. He also has considerable acquisition finance and general bankng expertise.

He has advised a range of high profile clients such as Compañia Sud Americana de Vapores S.A. (CSAV), National Express and Schahin Petróleo e Gás S.A. and banks including BNP Paribas, Citibank, China Development Bank, ING and Société Générale in the asset finance space.

He has advised private equity houses such as Carlyle Group and Apax; and restructuring firm Alix Partners. In mainstream finance, Alexander has also represented Vodafone in a number of its financings.

Sharon Lewis, global head of Hogan Lovells’ finance practice, said: “Paris is an important hub for asset finance, particularly aircraft and shipping finance, with French banks playing a leading role in high value, complex asset finance transactions. Hogan Lovells has strong and well-recognised French law asset finance and banking practices in Paris and Alexander’s arrival will help us to capitalise on market opportunities and grow our English law asset finance and mainstream finance capability both locally and globally”.

Premont added: “Hogan Lovells attracts high quality, complex finance work that will allow me to experience a greater variety and complexity of asset finance and mainstream finance work. The Paris market offers significant opportunities and Hogan Lovells’ Paris office offers one of the best platforms from which to exploit them. I am very much looking forward to working with the team to grow a stand-out English law asset finance and mainstream finance practice not only in Paris but globally”.