Summary

Why are we so interested in AI?

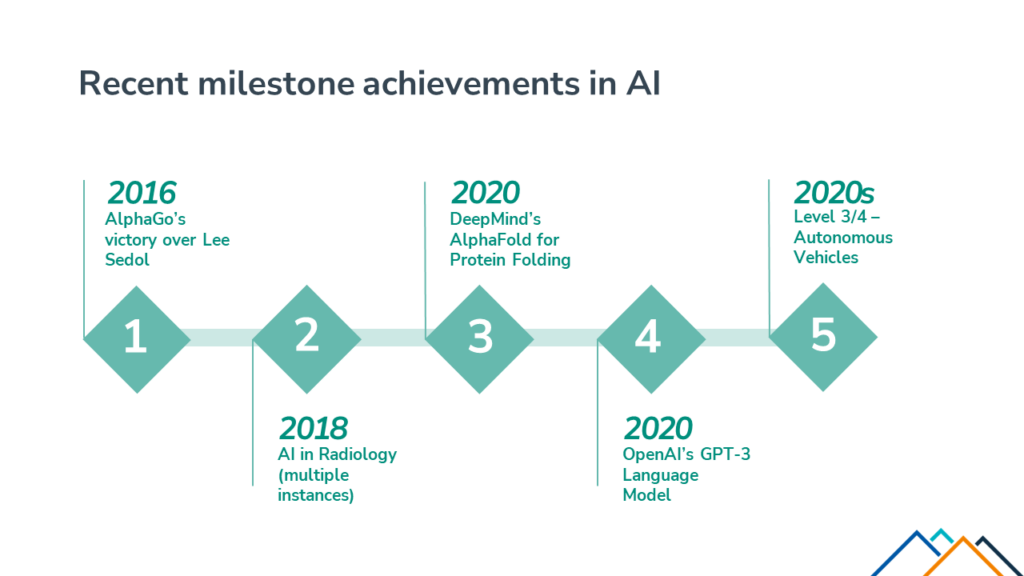

Artificial Intelligence (AI) has been around for many years, starting its journey in 1956. But with the release and accessibility of generative AI applications such as ChatGPT, the AI phenomenon has exploded across the globe.

Sponsored by Lendscape, the technology session at the 2023 Asset Finance Connect Autumn Conference discussed whether AI technology will be a game-changer for the asset finance industry and the challenges the sector must face in adopting artificial intelligence.

Martin Goodson CEO of Evolution AI commented: “AI technology has fundamentally taken a step forward in recent years, and it is only now that we are becoming more interested in AI and the rewards it brings.”

Andy Trimmer, Head of Technology at Simply pointed out that AI as a subject has become increasingly conversational in recent years with the growth of AI infrastructure. Suddenly everyone can access AI and people are seeing the realisation of what it can do with huge breakthroughs from ChatGPT. As Trimmer noted, “It’s nothing new, it’s just become accessible.”

Over the past 18 months we have seen exponential growth in AI with massive breakthroughs every week, but Goodson highlighted that, once AI reaches the limits of data that is publicly available, there will be a natural slowing of AI power.

With a growing AI user base and increasing amounts of data available, people are starting to wonder what AI can do for their business models.

Katherine Meredith, Head of Data Science at Paragon Bank sees AI as the complete opposite of blockchain which was a solution looking for a problem; we now have problems that AI and machine learning can solve: “AI is being used in motor finance and asset finance to solve problems we tackle on a daily basis.”

Potential of AI

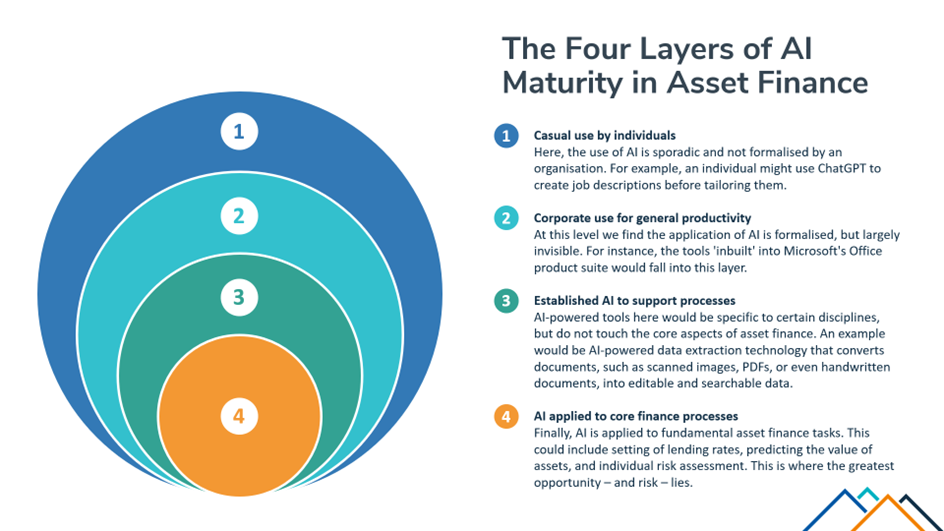

Artificial intelligence is causing anxiety amongst some workers who fear losing their jobs to AI technology. But in his book, Human + Machine, Paul Daugherty, Chief Technology and Innovation Officer at Accenture confirmed that won’t be the way in the future. AI machines will be there to complete mundane routine processes while humans will continue to do jobs that only humans can do. AI will be creating decisions that humans would then interact with and then it would be a collaboration, augmenting the roles not replacing them.

Likewise, Novuna Business Finance are not seeing the use of AI as a way of replacing humans, but to get AI to perform routine data-processing tasks (which can be done more efficiently with technology, giving a better customer experience) so that team members can be better utilised in the business to add extra value-added services where a personal touch is needed.

Graham Lines, Head of Innovation & Delivery at Novuna Business Finance confirmed, “AI is not about replacing humans and slashing costs; it’s about rethinking our business and our proposition to our customers with the help of technology.”

Following impressive results from a no-regrets proof-of-concept work, Lines could see the benefits at scale that AI could offer the business. Accordingly, Novuna established a dedicated team looking at AI and automation within the business, also encompassing data, to encourage the business to push forward with the transition.

By adopting a ‘test to prove’ approach, Novuna are building confidence from an investment point of view but also confidence from the business and users, which will then grow.

At Paragon, Meredith has put together a business case for each AI model and use: “If you get the problem right and define what the objective is, the business case does fall out the back end.”

Trimmer believes that a risk and reward approach needs to be adopted to explain the benefits of AI and prove the rewards in a way that people can understand and see, allowing businesses to take a “leap of faith”.

However, Goodson believes that people no longer feel threatened by AI: “The view that humans would perform the creative roles while machines will do the boring donkey work is outdated. We need to rethink things.”

A recent paper by Boston Consulting Group applied a golden pattern to AI capabilities in the banking sector whereby AI processes the information and evaluates it using traditional predictive AI capability, and then uses generative AI to produce a textual output to be interpreted by a human. The combination of these two capabilities could be particularly powerful and demonstrates AI’s ability to perform creative as well as processing roles.

Meredith agrees that we need to get away from the ‘humans or AI’ debate as there can be a combination of both together as a partnership, while Trimmer points to a triangle of people, process, and technology (AI) when it comes to problem solving: “While you can’t take away the people or the learning, AI takes us forward in a different direction and allows us to tackle age-old problems in a different way.”

Steve Taplin, Managing Director at Lendscape and moderator of the technology panel addressed a potentially interesting future use for AI for integrating interfaces to an IT landscape. Large-language models could be used to understand the context of various systems’ APIs and then those systems could talk together in a textual language but each using its own API approach to achieve that integration.

Value-driven opportunities for AI in the asset finance industry

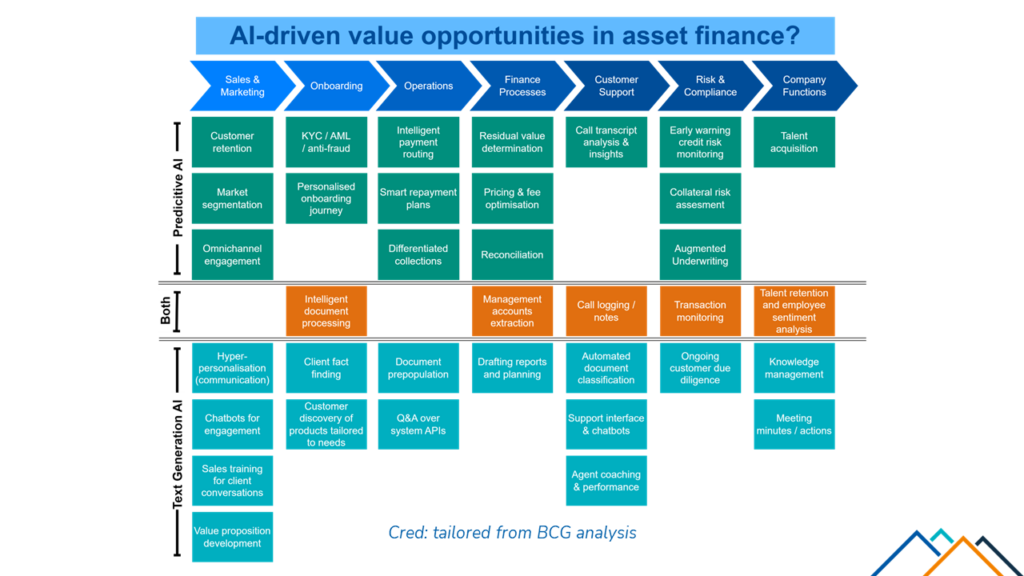

In their analysis of the core banking sector, Boston Consulting Group looked at all the areas where there was meaningful introduction of AI into various processes in the value chain of core banking.

Looking at the research through an asset finance lens, the chart above highlights areas where AI can be implemented. The technology panel agreed that AI can be used whenever data is utilised in a business including:

- Operations – a manual clunky process that is tricky to manage with many data sources – AI can be used to replace manual matching and inputting of data.

- Underwriting – underwriting decisioning processes can be augmented through the use of AI.

- Fraud – AI can be used to identify potential fraudulent activity, throughout the finance lifecycle.

- Identity verification – AI can be used to validate and authenticate an individual’s identity.

- Early warnings of financial distress – AI can pick up early warning signals of payment default.

Challenges of adopting AI in asset finance

Do we have enough data? While the use of AI in asset finance businesses would enable more efficiency, more business, and less room for human error, we need to ensure that there is enough good quality data in the industry to be able to produce reliable AI solutions.

Paragon’s Meredith believes that, as well as introducing data structures for capturing data (for example, at entry point and point of decision), the industry also needs to increase its coverage and find a way of getting the information about the customer through brokers and intermediaries.

An industry collaboration on data in an asset register would also present more opportunities in different areas.

Graham Lines notes that, “it is critical to make sure that the data you’re using for AI or any automation is as accurate as you can make it in the first place.”

People skills. The adoption of AI requires an inhouse team of AI and data science talent with specialist skills. But while this talent can drive a totally different insight into data and AI processes, they come at a high price.

The panel concluded the technology session with some words of wisdom for those embarking on the AI journey.

Graham Lines warned the asset finance industry to be cognizant of the risks, challenges and biases of AI technology.

Katherine Meredith advised asset finance businesses to find a pain point, define clearly what you want to achieve, and then see what AI machine learning can provide.

Andy Trimmer recommended simply giving companies and teams the ability to play with AI in a safe way and see the abilities that come from that: “Innovation stems from people doing the doing and if you give them more, then your business will fundamentally get more.” Steve Taplin agreed: “It’s time to play with this technology and figure out what it can do.”

Evolution AI’s Martin Goodson, who has spent many years working in the AI field, admitted that he has “never been so uncertain about the future, but has also never been so excited about what is possible.”