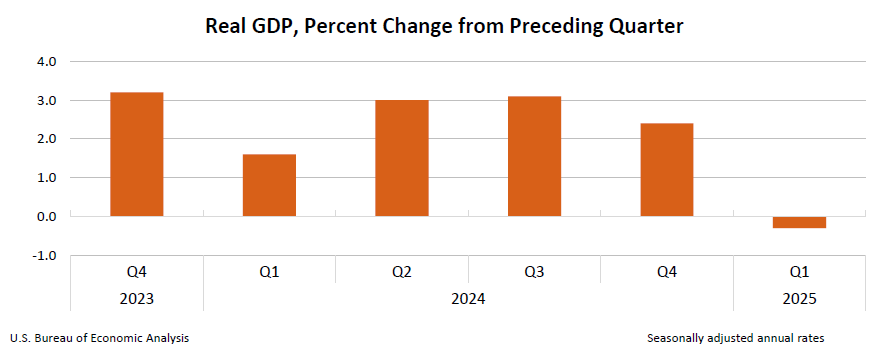

The US economy shrank by an annualised rate of 0.3% in the first quarter of 2025, marking the first contraction in three years, according to the US Bureau of Economic Analysis. This decline contrasts with the 2.4% growth observed in the previous quarter and falls short of economists’ expectations of modest growth.

The downturn is largely attributed to a significant surge in imports as businesses accelerated purchases ahead of impending tariffs introduced by President Donald Trump’s administration. This pre-emptive stockpiling led to a record trade deficit, which subtracted 4.8 percentage points from the GDP. While inventory accumulation added 2.3 percentage points, it wasn’t sufficient to offset the negative impact of the trade imbalance.

Consumer spending growth decelerated to 1.8%, down from over 3.7% in late 2024, influenced by severe winter weather and a post-holiday slowdown. Business investment appeared robust but was primarily driven by pre-tariff purchases and inventory stockpiling.

President Trump attributed the economic contraction to the “Biden Overhang,” distancing his administration’s policies from the downturn.

He emphasised that the negative indicators were inherited from the previous administration and not a result of his new tariff measures. The administration has implemented a 10% baseline tariff on most imports, with higher rates on specific goods, aiming to encourage domestic production.

Financial markets reacted negatively to the GDP report, with major stock indexes experiencing declines. Economists express concern that continued trade tensions and tariff escalations could further dampen demand and restrict hiring. The Federal Reserve has indicated it will hold interest rates steady amid these uncertainties.