The percentage of UK small business predicting growth for the final three-months of 2024 remains at the two-year high of last quarter (35%) – with significant upturns in growth forecasts across the North, the Midlands and among younger businesses – according to new research from Novuna Business Finance.

Despite market uncertainty about what lies ahead in this month’s Autumn Budget, Novuna’s findings follow reports that the UK economy returned to growth in August, with inflation falling back to the Bank of England’s 2% target – and tipped this week to fall below two per cent target for the first time in more than three years.

The quarterly tracking research from Novuna, now in its tenth year, goes beyond an attitudinal snapshot of business confidence and instead tracks the percentage of business owners that forecast actual business growth each quarter. The last quarterly cycle of Novuna research, conducted immediately after July’s General Election, revealed a two-year high for the percentage of enterprises that predicted growth (35%). The new Q4 figures – 35% again – suggest this summer bounce-back was not a flash in the plan but could be the start of a new, sustainable, period of growth outlook for UK small businesses.

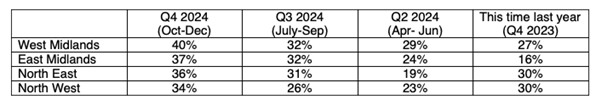

With the UK economy’s stagnation and recession moving towards a period of moderate growth, the Novuna Business Finance study indicates that, since the General Election, the quarter-on-quarter upturns in small business growth forecasts are happening in the North and the Midlands, rather than the South East or South West. In the North East, small business growth forecasts have jumped from 19% to 36% since the eve of the General Election.

Novuna’s research noted similar rises in the North West (up from 23% to 34%), the East Midlands (27% to 37%) and West Midlands (up from 29% to 40%). Conversely, whilst growth outlook is usually disproportionately strong in Central London (57%), small business growth outlook has become subdued in the South East and South West, with no meaningful seasonal rises for Q4 (35% and 23% respectively).

Q4 2024

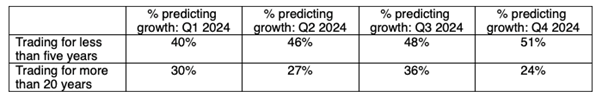

In addition to evidence of resurgent small business confidence in the North and Midlands, younger businesses (those trading for less than five years) have seen growth forecasts improve over four consecutive quarters during 2024. In contrast, among older businesses (those trading for more than 20 years), growth outlook has fallen this year. The smaller size and digital agility of younger businesses has, perhaps, made them more able to adapt to change this year.

The picture by industry sector on growth outlook has shown signs of volatility and variance over the course of 2024. That said, a 12-month view, comparing to the current position to Q4 2023, reveals that more small businesses now predict growth in the manufacturing, construction, retail, media, education, real estate and agricultural sectors. Since the General Election of early July, a greater percentage of business owners today predict growth in seven industry sectors: construction, retail, IT, leisure, media, agriculture and real estate.

Jo Morris, Head of Insight at Novuna Business Finance, commented on the findings: “Whilst there is a lot of speculation on what lies ahead for businesses in the Autumn Budget, the last four months have been a period of relative positivity and consistency for UK small businesses.

“For the last two consecutive quarters, 35% of small business owners have told us they forecast growth, which represents a marked upturn from 30% before July – and the years between Covid and the cost-of-living crisis, which was a period stagnation in terms of small business growth forecasts.

“As the Government pledges to create equity of opportunity more broadly across the UK, it is noteworthy from our data that small business growth is on the rise across the Midlands and the North. There are challenges ahead this autumn, as eyes turn to the Autumn Budget and the economic ramifications of the US Presidential election result, but UK small businesses go into Q4 in their most buoyant mood for two years – and we at Novuna Business Finance will be supporting mature businesses to help them invest in future growth initiatives and to realise their full potential.”