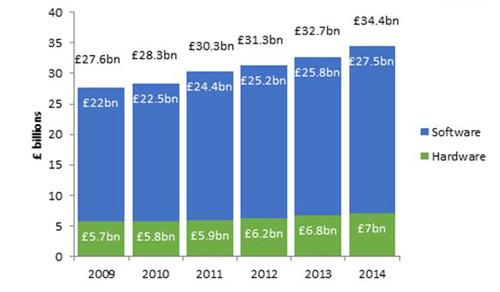

Business investment in IT hardware and software in the UK is currently running at a 24% increase since the recession.

Private sector IT investment has now far exceeded its pre-crisis peak of £30.9 billion in 2008.

Investment in information and communications technology* has hit a new record high, jumping to £34.4 billion last year – up by a quarter (24%) since the height of the recession in 2009, when businesses’ IT capital spending was just £27.6 billion.

This growth is being driven by investment in software, which has jumped by 6% in the last year alone from £25.8 billion in 2013 to £27.5 billion in 2014. In Q1 2015, businesses spent £6.9 billion on software.

Software now accounts for 80% of businesses’ IT capital expenditure, up from 74% some 10 years ago.

Investment in software is surging ahead because while most hardware has become relatively cheap and increasingly standardised, developments in software are advancing all the time.

Whether that’s industry- or application-specific software such as accounting or design packages, supply chain management programmes or sophisticated security software, businesses know that the right software will help them to be more efficient or provide better customer service than their competitors.

Managed IT services funded by leasing can help businesses keep IT costs under control.

As investment in IT continues to rise, we expect to see further growth in businesses’ use of ‘managed services’, with small and medium sized IT suppliers taking advantage of leasing to enable them to offer managed services to wider range of businesses.

The managed service model allows businesses to keep IT costs under strict control by outsourcing much of their IT requirements for a transparent all-inclusive monthly fee.

The same supplier provides configuration, network, security, training and maintenance services, along with the hardware and software and warranties. The fixed monthly payment can be better for cash flow compared to paying for equipment and support needs individually up front.

However, unlike cloud-based solutions, which offer some of the same advantages, there is no need for the buyer’s IT facility to be managed off-site. This is particularly important for businesses handling sensitive information and data.

With businesses increasing their capital investment, they want to keep their IT budget under strict control, but without the worries about data security that could come with switching to the cloud. Combining a monthly fee with an on-site service would offer the best of both worlds; helping businesses to keep any in-house IT function lean, and acquire expertise that they do not have themselves, without running up unexpected and unbudgeted costs.

Unfortunately too few small to mid-sized IT suppliers have been able to provide this sort of service, because it means funding costs like hardware, software, installation and consultancy upfront. Only the largest suppliers – typically working with the biggest organisations – are able to do that.

Leasing can help smaller IT suppliers to put these packages together, wrapped into a single fee. The leasing provider can fund all of the initial costs, which only leaves future costs such as ongoing maintenance to be funded by the supplier.

For IT vendors, being able to provide a managed service helps them to build valuable, long-lasting customer relationships. They prove their expertise by providing on-going support, making them a valued partner not just a one-off supplier. The predictability of the monthly payments is also an attraction.”

Vendors are increasingly asking us about the financing packages that we can provide to make all this possible.

Annual business investment in IT 2009-2014**

*Including computer hardware, computer software and telecommunications equipment. Private sector businesses excluding education and healthcare – based on Office of National Statistics information **Numbers may not total exactly due to rounding.

Tristan Watkins UK Country Manager for BNP Paribas Leasing Solutions