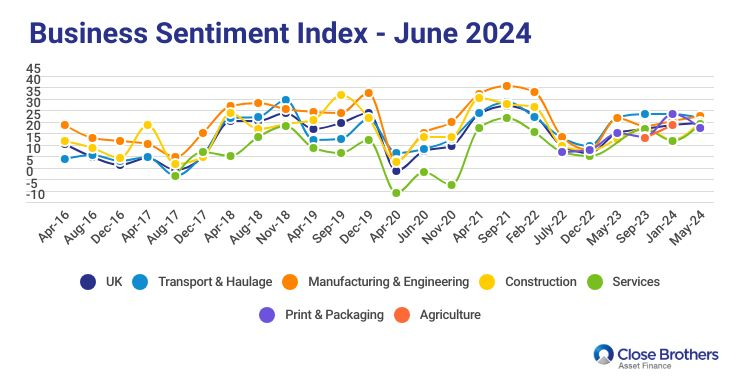

Close Brothers Asset Finance’s Business Sentiment Index (BSI), which measures SME business confidence, has risen modestly for the sixth consecutive research period, nearing levels last experienced in early 2022, and level with September 2019.

Engineering & manufacturing sentiment improved for the second research period in a row while construction saw a significant recovery in confidence to reach levels last seen nearly two and a half years ago.

The improvement hasn’t been felt across the board, with transport & haulage, print & packaging, and agriculture experiencing moderate falls. Context, however, is important, because all three sectors had – at the start of 2024 – all seen an improvement in sentiment, but as the year has progressed various factors have impacted business owners’ confidence, ranging from seasonal dips in orders to one of the wettest winters on record affecting farmers and consumer spending alike.

BSI scores – June 2020 to May 2023

| Research date | BSI score | % change |

| May-24 | 24.5 | +3.11% |

| Jan-24 | 23.75 | +9.2% |

| Sep-23 | 21.75 | +8.75% |

| May-23 | 20 | +74% |

| Dec-22 | 11.5 | -24% |

| Jul-22 | 14.25 | -96% |

| Feb-22 | 27.9 | -12% |

| Sep-21 | 31.75 | +11% |

| Apr-21 | 28.63 | +97% |

| Nov-20 | 14.5 | +18% |

| Jun-20 | 12.25 |

Appetite for investment

Firms’ appetite to invest in their business in the coming 12 months remained stable at 66% (January 2024: 68%).

This stability is true across all the sectors, with the biggest improvement coming in Print & Packaging, which improved to 82% from an already high 78%.

According to an independent report by BVA BDRC, 51% of SMEs were using external finance and steadily increased their use of finance during 2023. The report stated: “For 2019 as a whole, 45% of SMEs were using external finance, declining to 37% for 2020 as a whole. The increase in 2021 to 43% was not maintained into 2022 but recent increases in use of traditional finance coupled with better data on those still repaying pandemic funding, sees use of finance up to 51% in the current period”.

Q: Does your business plan to seek funding for business investment in the next 12 months?

| Yes | No | ||

| UK total | May 2024 | 66% | 34% |

| January 2024 | 68% | 32% | |

| Construction | May 2024 | 61% | 39% |

| January 2024 | 60% | 40% | |

| Manufacturing & Engineering | May 2024 | 70% | 30% |

| January 2024 | 69% | 31% | |

| Print and Packaging | May 2024 | 82% | 18% |

| January 2024 | 77% | 23% | |

| Services | May 2024 | 54% | 46% |

| January 2024 | 59% | 41% | |

| Transport & Haulage | May 2024 | 69% | 31% |

| January 2024 | 77% | 23% | |

| Agriculture | May 2024 | 71% | 29% |

| January 2024 | 76% | 24% |

Missed opportunities

The number of companies that have missed business opportunities because of a lack of available funding continued to fall from 51% in December 2022 to 41% in September 2023 and 34% in May 2024.

This latest figure is back in line with the more normalised levels achieved for this question, last seen in May 2022, when 37% of respondents answered ‘yes’ to ‘have you missed a business opportunity in the last 12 months, due to lack of available finance?’.

A recent report by the Bank of England – based on their survey of 2,885 SMEs – stated: “Around three quarters of businesses reported that their investment levels were appropriate over the three years prior to the survey, but a fifth said that they had underinvested. Businesses that underinvested were more likely to have negative perceptions of their access to finance than those that invested appropriately”.

Q: Have you missed a business opportunity in the last 12 months, due to lack of available finance?

| Yes | No | ||

| UK total | May 2024 | 34% | 66% |

| January 2024 | 39% | 61% | |

| Construction | May 2024 | 31% | 69% |

| January 2024 | 34% | 66% | |

| Manufacturing & Engineering | May 2024 | 31% | 69% |

| January 2024 | 40% | 60% | |

| Print and Packaging | May 2024 | 37% | 63% |

| January 2024 | 37% | 63% | |

| Services | May 2024 | 29% | 71% |

| January 2024 | 33% | 67% | |

| Transport & Haulage | May 2024 | 41% | 59% |

| January 2024 | 41% | 59% | |

| Agriculture | May 2024 | 34% | 66% |

| January 2024 | 46% | 54% |

Economic outlook

Overall, small business owners remained – on balance – more positive than negative about the UK’s economic prospects for the coming year. That being said, it’s worth remembering that in November 2021, 75% of respondents were positive about the economy.

Looking more closely at the sectors, construction saw a 13% increase in positivity and Services an 18% uptick.

Both agriculture and print & packaging experienced a decrease of 11%.

Q: How would you best describe your business’s economic outlook for the coming 12 months?

| Confident economy will grow | Concerned economy will slow | There won’t be a significant change | ||

| UK | May-24 | 45% | 40% | 15% |

| Jan-24 | 46% | 40% | 14% | |

| Construction | May 24 | 52% | 35% | 13% |

| Jan-24 | 39% | 49% | 12% | |

| Engineering & Manufacturing | May-24 | 46% | 39% | 15% |

| Jan-24 | 50% | 35% | 15% | |

| Print & Packaging | May-24 | 31% | 53% | 16% |

| Jan-24 | 42% | 46% | 12% | |

| Services | May-24 | 49% | 35% | 16% |

| Jan-24 | 31% | 37% | 32% | |

| Transport & Haulage | May-24 | 46% | 36% | 18% |

| Jan-24 | 49% | 40% | 11% | |

| Agriculture | May-24 | 34% | 50% | 16% |

| Jan-24 | 45% | 45% | 10% |

Predicted business performance

Reflecting the overall BSI result, predictions about future business performance was relatively static.

Construction (+7%) and services (+5) saw the biggest gains, while agriculture (-14%) and print & packaging (-7%) experienced the biggest falls.

What hasn’t changed is that most firms expect to continue treading water in 2024, with their prospects remaining unchanged.

Q: In general, how do you expect your business to perform over the next 12 months?

| Expand | Stay the same | Contract | Close down | ||

| UK total | May-24 | 38% | 53% | 8% | 1% |

| Jan-24 | 40% | 50% | 9% | 1% | |

| Construction | May-24 | 42% | 50% | 7% | – |

| Jan-24 | 35% | 56% | 8% | 1% | |

| Engineering & Manufacturing | May-24 | 37% | 52% | 9% | 2% |

| Jan-24 | 42% | 47% | 10% | 1% | |

| Print and Packaging | May-24 | 33% | 55% | 12% | – |

| Jan-24 | 40% | 48% | 10% | 1% | |

| Services | May-24 | 37% | 59% | 2% | 2% |

| Jan-24 | 32% | 57% | 9% | 2% | |

| Transport & Haulage | May-24 | 45% | 44% | 10% | 1% |

| Jan-24 | 44% | 46% | 9% | 1% | |

| Agriculture | May-24 | 33% | 58% | 7% | 3% |

| Jan-24 | 47% | 41% | 9% | 3% |

Anton Nebbe, Head of PR and Communications at Close Brothers Asset Finance commented on the research: “It’s encouraging to see confidence returning to levels not seen in over two years, and any improvement is clearly positive news.

“Our research continues to reinforce the feedback we’re getting from stakeholders across our key sectors, which is that the recovery in sentiment is dependent on the industry they operate in. There are fluctuations influenced by a wide range of factors, from seasonality and weather to supply and cash flow.

“All this being said, our commitment to the SME community remains – we will continue to work with firms through the cycle, providing expert advice and building long-term relationships, as we’ve always done.”

Note: The BSI is based on the views of 907 business owners and senior members of the UK’s business community and calculated from data charting their appetite for investment in their business in the coming 12 months; access to finance and whether they’ve missed a business opportunity through lack of available finance; views about the UK’s economic outlook; and thoughts on their likely performance in the coming 12 months.