AFC Summer 2023 Conference: Fintech Innovator Award

Winner: Nivo

Sponsored by Lendscape and voted for by the Fintech Innovator judges and AFC conference delegates, the Fintech Innovator Award Winner for Summer 2023 is Nivo.

Matthew Elliott, Chief Commercial Officer and Co-founder of Nivo took to the stage at the Asset Finance Connect Summer Conference to showcase how generative AI based on ChatGPT style services can open up a range of possibilities for lenders, intermediaries and consumers, by plugging it in to Nivo’s secure messaging based communications platform.

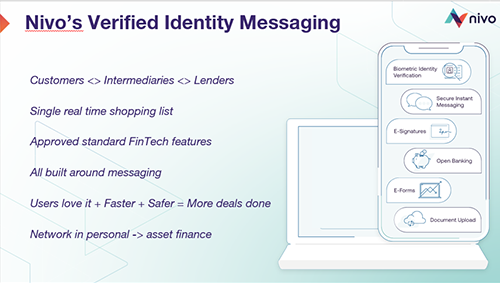

Nivo is a fintech company focused helping brands shift away from email, portals and post, to a faster and safer way to communicate. The solution combines biometric identity verification and secure messaging in one simple app that customers love, and allows intermediaries and lenders to gather and share all the evidence, documents, and approvals required for a loan.

Looking at generative AI through a human-centric lens, Nivo are focused on solving a communication problem facing the industry today with an AI GPT-style service which slashes the amount of time spent by people finding the latest documents, chasing for updates, understanding what’s done and what’s outstanding, clarifying lender policies, and getting management information on how their teams are performing.

Analysts see generative AI having a high impact on sectors which are time and knowledge intensive, involving learned expertise, a range of data sets, repetitive tasks, and high levels of administration or documentation — characteristics that are prevalent across the asset finance industry where skilled, experienced, relationship-focused specialists are matching niche products and services from a wide array of lenders to specific customer needs, driven by relationships and human interaction.

At the same time, these specialists are typically spending 70% of their time on repetitive administrative tasks. Nivo believes that far too much time is wasted gathering, sharing and checking the information required to get a deal done.

Nivo currently solves this issue with their Verified Identity Messaging app by combining people, data and natural language – but can AI help this process even further?

Matthew Elliot sees AI’s potential to take this even further by removing this drudgery and unlocking a new wave of productivity, not by replacing humans but as a co-pilot.

Nivo already has the scale, volume and type of data flowing through its bank-standard secure Verified Identity Messaging service, but with a Large Language Model (LLM) deployed over that network, Nivo’s Nevis AI co-pilot can sit in their existing interfaces and use their existing data to find answers to questions raised by Nivo’s clients.

Simple questions can be answered by focusing on customer and lender data, but by combining and connecting different data sets, Nevis can answer more in-depth questions and interrogate different policy documents to find the best deal for the client.

Nivo are keen to create the best possible customer experience when dealing with regulated service industries by taking out the timeless waste and deploying a generative AI solution in their secure mobile journey. With the industry’s increasing appetite for AI, as well as the limitless potential of generative artificial intelligence, who knows where it will take Nivo!

Find out more about Nivo at www.nivohub.com or contact Matthew Elliott at matthew.elliott@nivohub.com