UK banks including Lloyds and Barclays are at risk of a credit downgrade in the wake of the recent Court of Appeal decision in favour of customers regarding commissions that lenders pay to car dealerships for arranging loans, with Fitch Ratings warning that UK bank motor finance lenders face “considerable uncertainty and potentially significant implications”.

The influential agency’s note said that while the financial amounts in the three cases were small, the implications of the findings, which focused on the lack of adequate commission disclosure and a lack of informed consent, are much larger.

Fitch cautioned that the verdicts “go beyond the requirements set out by the Financial Conduct Authority (FCA) and could set a precedent that leads to significant liabilities for motor finance lenders. The ruling also raises considerable uncertainty over the implications of the FCA’s investigation of historical discretionary commissions for motor finance, announced in January.”

The agency warned that the ruling materially increases the likelihood of a redress scheme to compensate customers, which could have large financial implications.

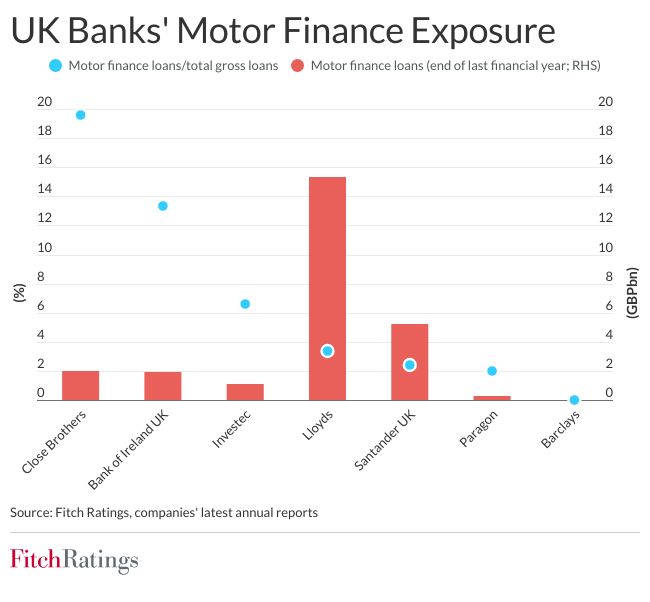

Fitch has placed the ratings of Close Brothers Group on Rating Watch Negative due to the lender’s relatively high exposure to motor finance and smaller loss-absorption capacity in absolute terms.

It stresses that the ratings of other lenders that have been significantly involved in motor finance lending are not immediately affected. That list includes Bank of Ireland UK, Barclays, Investec Bank Plc, Lloyds Banking Group, Paragon, Santander UK, and FirstRand Bank due to its ownership of MotoNovo.

Compensation

In its analysis, Fitch argues that any potential compensation costs are unlikely to be as large as those for PPI, and also points out that UK banks’ profitability has strengthened in recent years, supported by higher interest rates and contained impairment costs.

But it also states: “However, more ratings could come under pressure if remediation costs affect earnings, capital ratios and business growth prospects over a prolonged period. Lloyds Banking Group, Santander UK and Barclays have the strongest loss-absorption capacity due to their large pre-impairment profits and capital, and relatively small exposure to motor finance.”

The agency predicts the ruling is also likely to prompt stricter regulatory scrutiny and necessitate changes in business practices to ensure compliance with disclosure requirements. Lenders may need to reassess their agreements with brokers and dealerships to limit the risk of legal challenges and having to pay compensation.

Lloyds Banking Group, which owns Black Horse, and is Britain’s largest car finance business set aside £450 million against the FCA’s motor finance review earlier this year, and has now suspended commission payments for new motor finance loans. Santander UK has delayed its publication of third-quarter results to assess the impact of the ruling. Investec Bank had set aside £30 million against the FCA review, while FirstRand Bank Limited had provisioned equivalent to £127 million for risks in its UK motor finance operations.

Fitch says each lender’s potential remediation costs will depend on the size and nature of its motor finance portfolio, the commission arrangements that were in place, and whether and how they were disclosed. The proportion of motor finance in loan books ranges from 2%–3% at LBG, Santander UK and Paragon to about 20% at Close Brothers Group. Barclays had exposure before it stopped motor finance lending in 2019.

Additionally, the credit ratings agency points out that it is not clear whether the ruling on motor finance will affect other consumer finance segments.

“A lengthy look-back period across multiple lending segments could raise the risk of more material redress processes. Prolonged industry-wide uncertainty and potential retroactive legislation could weigh on Fitch’s assessment of the operating environment for UK banks, particularly if it disrupted business growth, increased operational risks and weighed on earnings and capital for a sustained period,” the analysis concluded.

Edward Peck, Asset Finance Connect CEO, said: “The scale of the financial impact of the Court of Appeal ruling is only just starting to emerge, and many parts of the industry are still locked in crisis consultations with lawyers. Its no surprise that this is impacting the value of lending businesses, and the cost is unlikely to be limited only to hopefully temporarily lower share prices.

“The real challenge in this post-verdict landscape will be to get to grips not just with the legal consequences of the judgement; but also with its commercial implications. Our perspective needs to move beyond legal advice to identify strategic imperatives for the industry. The winners post-verdict will be those who can align their business objectives to the legal/regulatory environment in which it is now clear we are operating.

“The AFC conference on November 26th will help lenders and brokers to share their ideas and thoughts on how to do this. Through our sessions at the event we hope we can spark some new ideas among members; innovations that will enable the industry to rebuild better and stronger.

“Changes to the agenda will be announced imminently.”

Ticket information for the AFC UK Autumn 2024 Conference can be found on the conference website or directly from Louise Clavey at louiseclavey@assetfinanceconnect.com.