As the UK’s automotive industry accelerates towards electrification, Cox Automotive’s latest Insight Quarterly (IQ) report offers a comprehensive analysis of the current electric vehicle (EV) market and its future trajectory. The report underscores significant shifts in fuel preferences, policy impacts, consumer perceptions, and the maturation of the used EV market.

EV market share and growth

The UK’s automotive sector is undergoing a profound transformation in its fuel composition. While petrol remains the predominant choice, its market share has diminished by 26.61% since 2020. Diesel has experienced an even sharper decline, plummeting over 76% to constitute just 6% of the current market. In stark contrast, EV and hybrid vehicle registrations have surged.

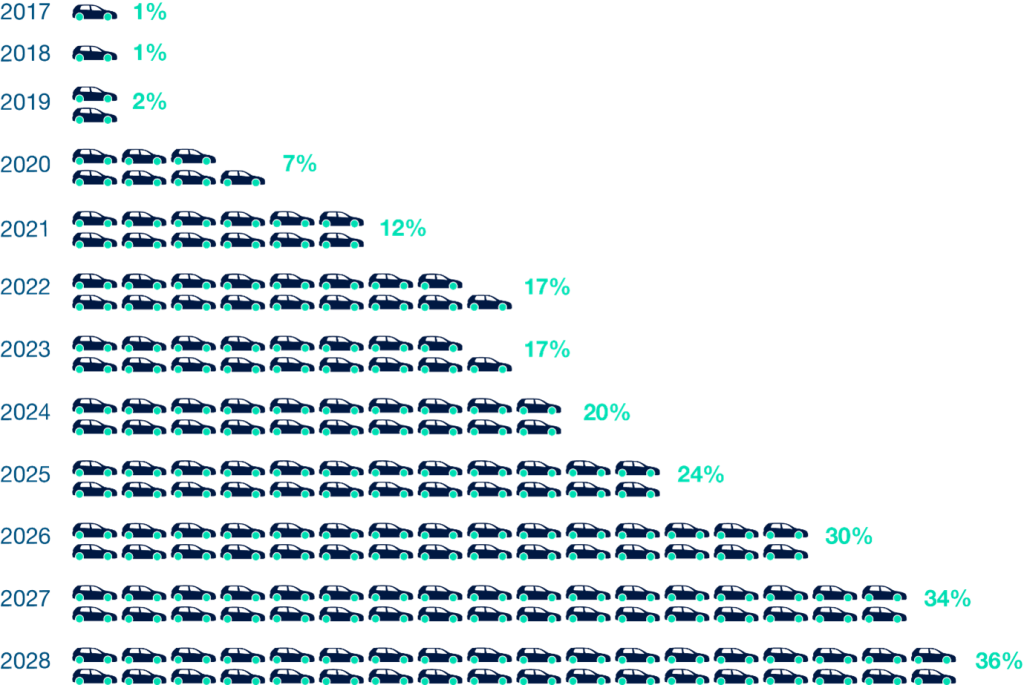

Since 2020, EV registrations have escalated by 560%, bringing nearly 979,000 electric vehicles onto UK roads. Hybrids, encompassing plug-in hybrid (PHEV) and hybrid electric vehicles (HEV), have risen by 151%, now representing 22% of the market. Projections indicate that by 2028, EVs will account for 36% of new car registrations, surpassing petrol as the leading fuel type.

Total percentage of new car registrations that were EVs

This momentum is propelled by Zero Emission Vehicle (ZEV) mandate pressures and the emergence of new market entrants offering more affordable EV options, compelling established brands to innovate and adapt.

ZEV mandate and government support

Government policies play a pivotal role in driving EV adoption. However, ongoing ZEV mandate consultations have introduced a degree of uncertainty within the industry. While the mandate sets ambitious zero-emission sales targets, businesses seek clearer guidelines, financial support, and long-term policy stability to achieve these objectives.

The Insight Quarterly report, developed in collaboration with automotive expert Regit, reveals that 64% of consumers believe the government bears the primary responsibility for accelerating EV adoption. This sentiment underscores the necessity for policymakers to engage with both consumers and industry stakeholders to address the genuine challenges of electrification and provide the necessary commitments to foster EV adoption.

Consumer perspectives on EV adoption

Despite the upward trend in EV registrations, misconceptions persist among consumers. The research indicates that 79% of consumers have never driven an EV, leading to widespread misunderstandings. Conversely, among those who have transitioned to EVs, 87% report that their vehicles met or exceeded expectations, suggesting that firsthand experience enhances confidence. While 42% of EV drivers observed discrepancies between advertised and real-world battery range, only 25% reported significant range issues, implying that range anxiety may be overstated.

Charging infrastructure challenges

Access to dependable charging infrastructure remains a significant concern for UK drivers. An overwhelming 82% of EV owners rate the nation’s charging facilities as ‘poor’. Specifically, 28% struggle to locate public chargers, leading to potential range anxiety, and 26% find charging costs prohibitive.

Nearly half (45%) highlight geographical disparities, with rural regions in the South East (26%), the Midlands (16.6%), and Scotland (15.3%) facing more pronounced charging access issues.

Incentives and industry responsibilities

The majority of consumers (86%) feel that current government incentives to support EV adoption are inadequate.

Key policy enhancements desired include increased financial incentives, improved charging infrastructure, and greater transparency in EV-related information. Additionally, consumers assign responsibility to industry players: 49% believe dealerships should better educate buyers, 42% expect fuel companies to expand charging options, and 41% urge manufacturers to enhance EV affordability and transparency.

These insights suggest that both policymakers and industry participants must collaborate to address these concerns and facilitate broader EV adoption.

Evolution of the used EV market

The used EV market is transitioning from uncertainty to stability. Early adopters faced significant depreciation, but prices are now stabilising, indicating a positive trend for buyers and sellers alike. Projections show that by 2028, EVs will constitute 36% of new car registrations, reflecting growing consumer interest and an expanding supply of second-hand models.

However, lingering concerns about battery degradation, uncertain resale values, and overall ownership costs continue to impede mass adoption in the UK.

Looking ahead

The path to widespread EV adoption hinges on addressing both consumer and industry apprehensions, according to the Cox Automotive report. The research indicates that once consumers transition to EVs, their concerns tend to diminish.

Policymakers are tasked with implementing financial incentives and investing in infrastructure to make the switch to EVs more appealing. Simultaneously, dealers, original equipment manufacturers (OEMs), and fleet operators must focus on educating consumers about the benefits and practicalities of EV ownership.

Without targeted improvements and collaborative efforts, the momentum of EV adoption may face significant challenges.