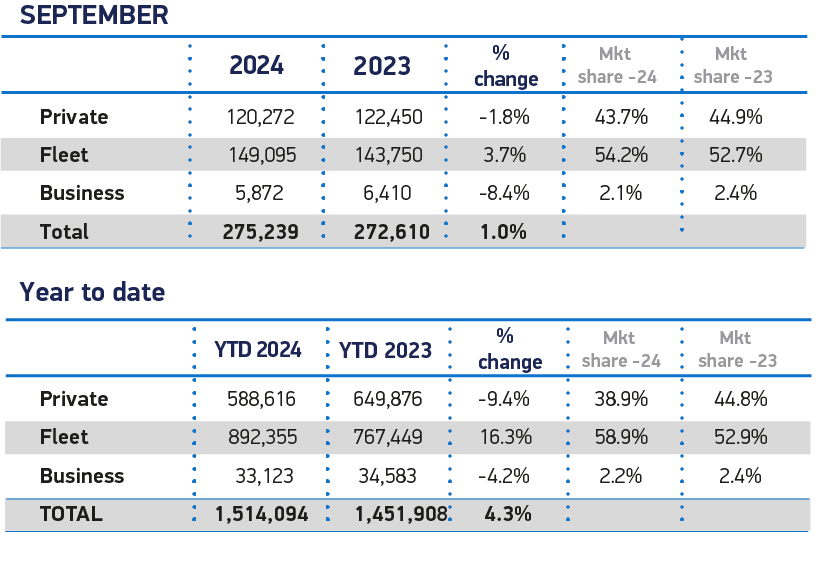

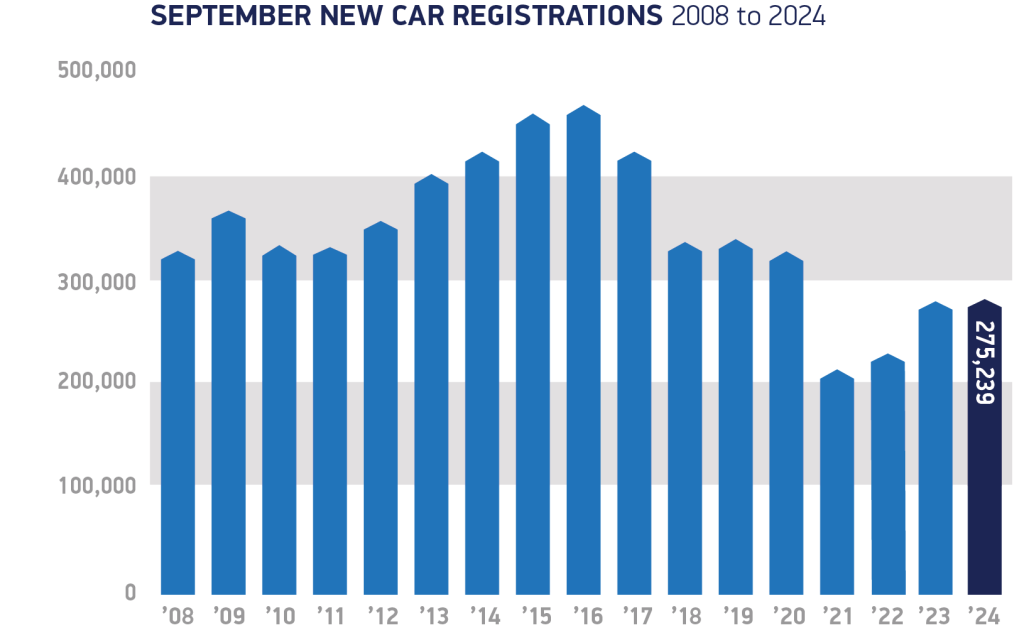

The UK new car market rose 1.0% in the key ‘74’ plate change month of September, to 275,239 units, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). In what is traditionally a bumper month for new car registrations, second only to March, the performance was the best since 2020, but still -19.8% off pre-Covid September 2019.

Growth was driven by fleet purchases, up 3.7% to 149,095 units and representing 54.2% of the overall market. Private consumer demand fell, by -1.8% to 120,272 units, accounting for 43.7% of registrations, while the smaller business sector saw volumes fall -8.4% to 5,872 units.

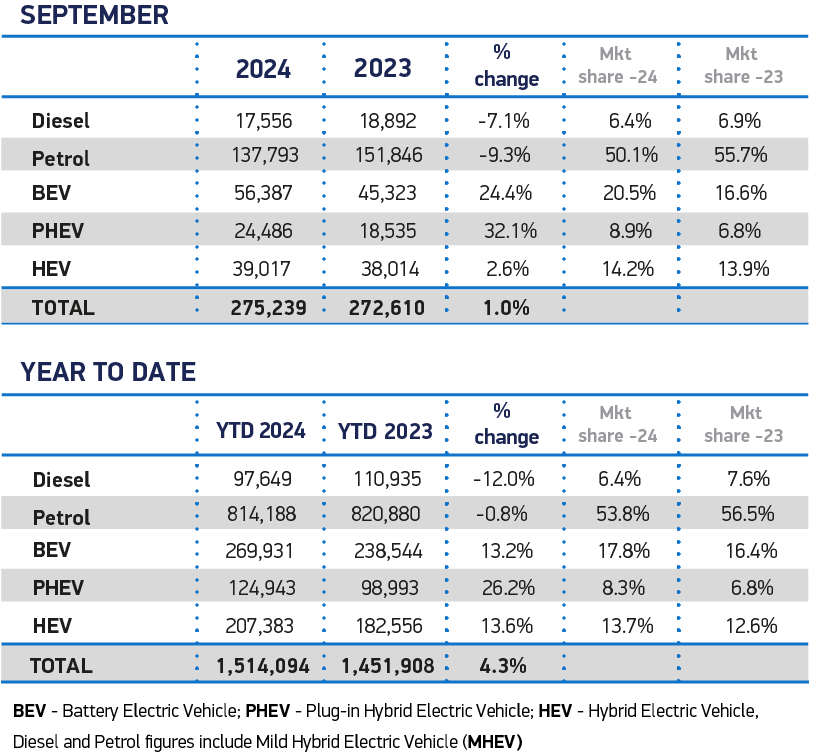

Uptake of plug-in hybrids (PHEV) grew faster than any other fuel type in the month, up 32.1% to take an 8.9% share of the market. Hybrid electric vehicle (HEV) registrations rose 2.6%, boosting market share to 14.2%, while petrol and diesel registrations declined by -9.3% and -7.1% respectively, although together they were still the choice of 56.4% of buyers in September.

Demand for the latest battery electric vehicles (BEV) hit a new record volume for any month in September, up 24.4% to 56,387 units, achieving a 20.5% share of the overall market, up from 16.6% a year ago. This was not enough, however, to shift market share significantly, which edged up from 17.2% in the first eight months, to 17.8% from January- September. It is expected to reach 18.5% by the end of the year.

Fleets drove much of this growth, with deliveries rising 36.8% to account for more than three quarters (75.9%) of BEV registrations. Private BEV demand also rose, up 3.6% after unprecedented manufacturer discounting, but this was equivalent to just 410 additional registrations. Consumer demand for diesel grew at a faster rate, increasing 17.1% in September – a volume uplift of 1,367 units.

Year-to-date private BEV demand remains down -6.3% – underlining the scale of the challenge involved in moving the mass market to meet the mandated targets that were conceived in very different economic, geopolitical and market conditions. Previous assumptions of a market delivering steady BEV growth, cheaper and plentiful raw materials, affordable energy and low interest rates have not come to fruition, with the upfront cost of BEV models remaining stubbornly high. Added to this is consumers’ lack of confidence in the UK’s charging provision – despite recent investment and growth – which still acts as a barrier to BEV take up.

In an effort to offset this underlying paucity of demand, SMMT calculates that manufacturers are on course to spend at least £2 billion on discounting EVs this year. Given the many billions already invested to develop and bring these models to market, the situation is untenable and threatens manufacturer and retailer viability. For this reason, SMMT and 12 major vehicle manufacturers representing more than 75% of the market, have today written to the Chancellor calling for measures to support consumers and help speed up the pace of the EV transition. These include:

- Temporarily halving VAT on new EV purchases to put more than two million new ZEVs (rather than petrol or diesel) on the road by 20283

- Scrapping the VED ‘expensive car’ tax supplement for ZEVs, due next year, to avoid penalising buyers

- Equalising VAT on public charging to match the 5% home charging rate, and mandating infrastructure targets to support those who cannot charge at home

- Maintaining and extending the business incentives that are working, including Benefit in Kind which supports company cars and those on salary sacrifice schemes, and the important Plug-in Van Grant

Mike Hawes, SMMT Chief Executive, said, “September’s record EV performance is good news, but look under the bonnet and there are serious concerns as the market is not growing quickly enough to meet mandated targets.

“Despite manufacturers spending billions on both product and market support – support that the industry cannot sustain indefinitely – market weakness is putting environmental ambitions at risk and jeopardising future investment. While we appreciate the pressures on the public purse, the Chancellor must use the forthcoming Budget to introduce bold measures on consumer support and infrastructure to get the transition back on track, and with it the economic growth and environmental benefits we all crave.”

Ian Plummer, commercial director at Auto Trader, commented on the latest new car registrations figures from the SMMT:

“Electric vehicle sales surged in September to claim a 20%-plus share of the market, in the key plate-change month for the industry, but it still won’t be enough for many manufacturers to hit sales targets under the Zero Emissions Vehicle mandate.

“Record discounts are driving the interest as brands and retailers do all they can to stimulate sales, showing once again just how sensitive the market is to financial incentives, and the importance of overcoming the current EV cost barrier. These efforts are also reflected in the strongest interest in new EVs on our platform for more than two years, a good sign that the remaining months of 2024 should also see strong new EV sales,” Plummer continued.

“That said, there’s still much to do to drive further levels of interest and actual sales – and discounts can only last so long. Given affordability is such a key driver of purchase, other measures are needed to help buyers make the switch to electric cars which still carry a 30% price premium over their ICE counterparts. More affordable EVs are hitting the market from both established and new brands alike, but we need to see further levels of support from Government if we’re to hit the new regulatory targets without inflicting significant damage to the industry.”

James Hosking, Managing Director of AA Cars, commented: “The new car market rebounded in September after stalling in the previous month — fuelling hopes that the slowdown was just a bump in the road.

“After two years of continuous growth — fuelled primarily by rising fleet sales in recent months — the sector experienced a setback in August due to the ongoing decline in private purchases.

“Summer is typically a slower period for new car sales, with many drivers delaying purchases until September to take advantage of the new plate change and the latest 74 registration. This helps to explain the boost in September’s sales and renewed growth in the market, supported by strong fleet purchases. However, private sales dipped again by 1.8%.

“Sales of electric vehicles (EVs) and hybrids are on the rise, increasing by 24% year on year, as more drivers opt for greener choices. Our research shows that the prices of used EVs and hybrids on the AA Cars website dropped from £21,302 in Q3 2023 to £17,967 in Q3 2024 — a decrease of nearly 16%.

“This decline in prices is attributed to a growing supply of EV and hybrid models, improving accessibility for buyers in both new and used markets.

“Overall, the sustainability of growth in the new car market will largely depend on current economic trends. Inflation continues to sit around the Bank of England’s 2% target and interest rate cuts are anticipated, but uncertainty ahead of the October budget and potential tax increases could mean that nest eggs for new cars are shelved. While there is optimism about the sector’s resilience, some challenges may still lie ahead.”