Summary

In the financial services industry, the application of machine learning (ML) and artificial intelligence (AI) methods has the potential to improve outcomes for both businesses and consumers. In recent years, improved software and hardware as well as increasing volumes of data have accelerated the pace of ML development.

Asset finance companies are increasingly opening up to how these tools can benefit their businesses, and whilst there is concern about human jobs being replaced by machines, increasingly, the industry is recognising the opportunities in partnering technology with human decision making, not replacing it.

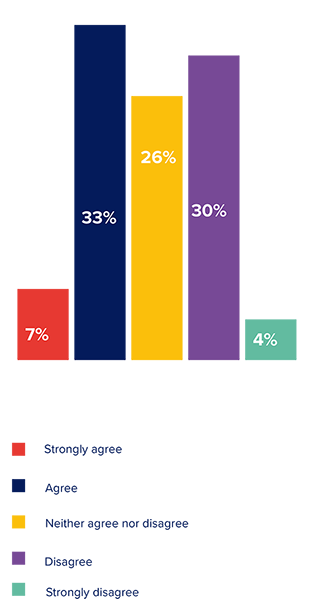

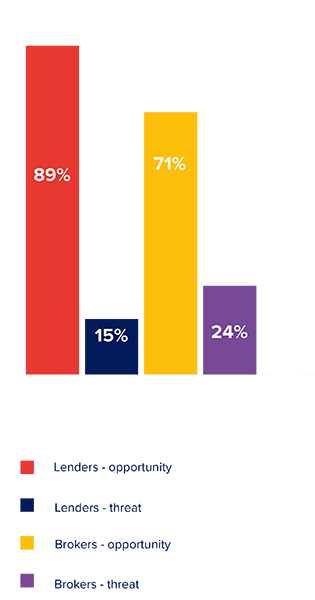

The findings from a recent poll during the AFC webcast on automated decisioning in asset finance lending highlighted this shift towards automation with both lenders and brokers unanimously seeing the increasing use of AI as an opportunity rather than a threat to the traditional lender and broker models.

About Allica Bank

Established in 2019, Allica Bank was built to serve established small and medium-sized businesses. Combining modern tools and technology with ‘a feet on the ground in local communities’ approach, Allica believe in using human relationships and tailored expertise to empower business owners with the tools they need to succeed.

Allica Bank has been ranked the #1 fastest-growing technology company in the UK in Deloitte’s 2023 UKFast50 Technology Awards. The list ranks technology companies based on their revenue growth over the past four years, with Allica Bank posting an increase of 85,438%. Based on previous results, that makes Allica the fastest-growing fintech and third-fastest growing technology company ever.

In April 2024, Allica Bank revealed it has lent over £500 million in asset finance. Having launched its asset finance arm in January 2021, over the past 12 months Allica has lent almost double the amount it lent in the previous two years combined. This comes following the bank recently revealing that it achieved its first full year of profitability in 2023, and that it has now lent a total of over £2 billion to established businesses.

Allica’s head of asset finance sales, Brandon Hall notes that the exponential jump in asset finance applications is down to being able to deliver consistent and fast decisions to brokers thanks to a mix of its technology and people.

Technology is key to Allica’s success, according to Hall, and is at the “top of the list” in terms of further improving Allica’s offering. Allica has recently launched its automated decisioning system (incorporating machine learning) which Hall sees as “a game changer,” allowing its team to spend more of their time on added value rather than administrative processes.

Despite being the “best in the market” for their documentation procedure, Allica is also looking to further improve this process by implementing more automation into the system.

Hall sees Allica’s mix of human relationships and powerful technology as key to their success, describing the Allica team as the company’s “biggest asset.”

Business case: Allica Bank

As a business bank dedicated to serving established businesses, Allica has used technology to differentiate their role from traditional banks.

With SMEs stuck in the middle of two traditional banking models – consumers and corporates – James Breteche, Product Owner at Allica Bank noted that traditional banks have subsequently underinvested in SMEs, presenting a huge opportunity for Allica Bank.

Unlike the one-size-fits-all legacy systems operated by many traditional banks that are expensive to upgrade and slow to respond to market changes, Allica had the advantage of starting their journey with a blank sheet allowing them to bring the right technology and people together, according to Allica’s Chief Technology Officer, Ravneet Shah.

Steve Taplin, Managing Director at Lendscape noted that increasingly lenders want to take a more service-based approach to building a technical platform that serves their underlying business. Integrating services will be easier if the other services and the main funding platform can integrate easily which is a main feature of modern systems.

With a ‘feet on the ground’ approach to banking, the Allica Bank model never involved technology replacing the ‘human touch’ which they see as an essential component of SME lending.

Allica’s aim is to bring relationship banking along with technology to their customers to enhance the customer experience. Shah explained how relationship managers work with SMEs at ground level to understand customer needs and product engineering/technology teams focus on automating processes to “create a value for the customer” by simplifying processes and removing the administrative load.

Allica used technology, not to reduce their own costs, but to bring value to its customers by focusing on the three key “moments of truth,” according to Breteche – speed to quote, speed to decision, and speed to payout.

Keeping customer experience at the top of the agenda, Allica gives an assurance that customers can contact Allica easily and not through chatbots. Shah pointed out that chatbots are generally used at Allica for knowledge-based FAQs.

Steve Taplin, Managing Director at Lendscape commented that the use of AI-driven chatbots is a growing trend within the financial services industry, but solving problems for customers still needs people to remain at the core.

Automated decisioning in asset finance

Credit decisioning has been a manual process in many smaller to medium lenders for a long time. However, automation has the potential to enable credit providers of all sizes to deliver better customer service, expand their operations, and stay ahead of competition.

The rewards of implementing automated credit decisioning tools are substantial:

- Revenue boost: The automation models can significantly increase revenue through higher acceptance rates, lower cost of acquisition, and improved customer experience.

- Decreased credit loss rates: Companies can see significant reductions in their credit losses by using models that more accurately determine customers’ likelihood to default, impacting the levels of provisions and capital a bank must hold.

- Improved efficiency: The implementation of digital tools can increase efficiency through automation of bank data extraction, prioritising cases, and improved model development

Allica Bank has recently launched their automated credit decisioning tool to streamline and speed up the customer journey. Automating the decisioning process brings operational efficiency, as well as improving the consistency of decisions.

With machine learning improving the consistency of decisioning and underwriting, Allica aims to get 50% of decisions automated across all channels (brokers, direct).

Breteche sees that, historically, lending institutions have implemented their automated decisioning model as a very parameter and rule-based auto decisioning model which gives a crude accept or decline. Allica, however, is focusing on narrowing the grey middle ground which traditionally is manually underwritten.

Allica Bank has had two generations of their automated decisioning models – a statistical model followed by an open-source ML model which can be trained with limited data. In the video clip below, Allica’s Shah highlights the challenges behind the scenes in understanding the data, building the rules, training and testing the model.

Data is a challenge when talking about automated decisioning. As a new bank, Allica does not have a lot of past data, so they used an external retro sample and historic book for data and testing their model.

To train the automated model to continue to produce better and improved outcomes, Allica took their historic book and compared the outcomes from both the automated decision process and manual underwriting. Breteche noted that the “model is constantly shadowing what the underwriters are doing today.”

The unintended bias from automated models is a challenge when training a system. Shah notes that dealing with potential bias in systems depends on the parameters you are using. And while she highlights that “no model is 100% perfect with no bias,” the more the system develops, the greater the chance to improve.

A model should provide a good explanation as to why a decision has been made and this is one of the biggest challenges, according to Shah.

Other opportunities to deploy AI in the asset finance credit cycle

“Asset finance companies are now more open than ever to how AI and ML tools can benefit their businesses,” according to Lendscape’s Taplin.

The best use cases for AI in asset finance are in automating administrative tasks, for example, extracting information from paper-based documents, along with the areas below:

- Operations and managing administration – inputting data and extracting information from paper-based documents

- Underwriting – underwriting decisioning processes can be augmented through the use of AI

- Compliance – with a lot of new regulation in the financial services, e.g. consumer duty, commission disclosure, AI/ML tools and tech can help with compliance and creating an audit trail

- Fraud management – automation can assist us to identify potential fraudulent activity, throughout the finance lifecycle but a network of humans is still needed as the strongest safeguard against fraud

- Identity verification – AI can be used to validate and authenticate an individual’s identity

- Improving the customer journey

- Collections strategy/ defaults

The integration of AI and machine learning into a business was initially met with fear and apprehension by many employees. However, Allica’s Breteche notes that if the tech is implemented properly to support people and make processes easier it should be well received. Training to show staff how it will support them and help them realise the benefits e.g. reduce their time, is an essential part of the integration of technology.

As a modern tech bank, it was easy for people to adapt to new automated processes at Allica. However, this can be a challenge for traditional banks with legacy systems and staff, making it harder to move quickly and integrate old systems with new technology.

Lending institutions need a “cultural shift” when looking at new emerging technologies, according to Taplin. Many businesses now see tech as an assistance tool that can do “a better job for the customer” rather than a means to get rid of staff.

Technology and AI do not replace the human touch and they alone cannot stop fraud. A combination of machine and human working together is the most important partnership within the financial services industry.

Steve Taplin concluded, “While there is a continual need for more education on understanding the benefits and challenges presented with AI and machine learning, it seems we are moving past the fear of humans being supplanted by machines. Increasingly, we are recognising the opportunities in augmenting human decision making, not replacing it.”