Summary

As fleets transition from traditional petrol and diesel vehicles to hybrids and electric vehicles (EVs), businesses face new challenges and opportunities. In the recent Asset Finance Connect webcast, sponsored by Bynx, panellists Charlie Cook (Rightcharge), David James (Right Fuel Card), and Mark Thomas (Ridecell), moderated by David Betteley (Asset Finance Connect), discussed the state of fleet electrification, the obstacles to cost-efficient charging, and the evolving role of data in managing electric fleets.

The shift to EVs and charging challenges

Historically, fleet refuelling was straightforward, supported by long-standing fuel card programmes. However, EVs have introduced complexity, with hybrids and fully electric vehicles each posing unique challenges. Hybrids often fall short in cost savings because many drivers fail to charge them at home, resulting in increased fuel costs due to the heavier battery and sporadic public charging. EVs, meanwhile, show optimal savings only when charged primarily at home, where low overnight tariffs can make energy costs a fraction of public or motorway charging.

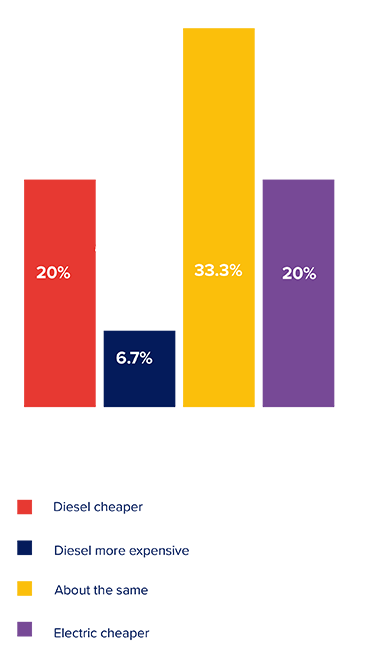

Poll results from the webcast indicated considerable uncertainty among delegates about the comparative cost of EV charging versus diesel refuelling, highlighting the need for better understanding and clearer communication on EV cost structures.

Drivers of EV adoption and current barriers

Rightcharge’s Charlie Cook noted that while EV adoption is growing annually in the UK, the pace falls short of targets needed for substantial carbon reduction. Public hesitation, fuelled by negative media coverage and shifting government mandates (like the changing deadline for the ban of ICE vehicles), has hindered uptake.

David James echoed these sentiments, stressing that “politics plays a big part in it!” Highlighting the strong influence of politics on stability and progress, noting that the UK, like many European countries, has experienced a seismic political shift this year. He emphasizes the need for political stability, arguing that consistency allows people to plan and invest in the future with confidence. James also points to the media’s tendency to focus on negative news stories, which he believes overshadows positive developments and feeds into a cycle of public cynicism.

Mark Thomas discussed similar challenges in the US, where the Inflation Reduction Act provides a $7,500 EV tax incentive, although only 7.5% of vehicles sold are currently electric.

David James believes that political decisions heavily influence the EV market, especially when it comes to the residual risks associated with these vehicles. While many consumers are concerned about issues like battery life, James argues that policy plays an even larger role, particularly through tax incentives favouring new EVs, such as those for company cars and salary sacrifice schemes. He points out that these incentives may inadvertently create problems, as they focus on new EV purchases rather than building a sustainable market for used electric vehicles. James suggests that government support should extend beyond tax incentives for new EVs, with policies to support the resale market and long-term affordability of second-hand EVs.

Despite consumer interest in EVs, especially in the luxury segment in the US, range anxiety and high depreciation rates persist as challenges, influenced partly by concerns over battery longevity and evolving technology.

Addressing home, workplace, and public charging issues

Charging logistics were another focal point. For many fleet drivers, charging at home offers the most cost-effective solution. Yet, managing home charging for fleet drivers presents unique hurdles, such as reimbursement complexities, differing electricity tariffs, and the availability of driveway space for home installations.

Rightcharge integrates home chargers and energy providers to streamline charging cost recovery, as well as providing a charging card for on-road charging, but as Cook mentioned, the next challenge is accurate, data-driven reimbursements.

In the US, stringent labour laws further complicate reimbursement, requiring precise receipts for business charging expenses. Thomas explained that emerging technologies may simplify the reimbursement process, but businesses still grapple with accountability and the high costs associated with public charging.

Incentivising efficient charging habits

Poll results showed that while 60% of respondents view home charging reimbursement as a minor deterrent for EV fleet drivers, the need remains for targeted incentives to drive home charging adoption among fleet drivers.

Cook pointed out that “the biggest cost for fleets who are public charging is not the energy but the downtime,” which massively outweighs the energy costs. Consequently, a better incentive structure for drivers to favour home charging would reduce overall fleet costs and enhance operational efficiency.

David James argues that EVs present a rare case where convenience and cost-saving align significantly, as home charging is typically more practical and cheaper for drivers. This benefit reduces the need for extensive education for EV owners, who are likely to naturally adopt home charging as their primary option. However, James highlights that fleet drivers will still require targeted incentives and education to understand the cost implications of public charging. Unlike home charging, public stations are often more expensive, making it essential to raise awareness around the savings that home charging can offer in contrast to public charging, especially as EV adoption continues to grow.

CO2 reporting and the importance of data

Data’s role in tracking CO2 emissions and complying with environmental regulations emerged as a central theme. Poll responses indicated optimism, with 70% believing technology will ease CO2 reporting burdens.

Cook underscored data’s importance, noting that Rightcharge can provide carbon tracking insights down to the energy source for each charging session, helping fleets make greener, data-backed decisions. As Cook noted, “Providing more data to our customers will not only support their reporting requirements but also empower them to make informed decisions and implement policies to lower their emissions.”

David James and Mark Thomas also stressed the potential of rich data in enhancing reporting accuracy and simplifying future regulatory compliance. As James noted, “we are getting to a place where the data will get richer and richer” and technology will help to minimise the burden of CO2 reporting.

Vehicle-to-Grid (V2G) technology: A future opportunity?

Looking ahead, Vehicle-to-Grid (V2G) technology promises fleet operators a cost-saving solution by allowing EVs to store and resell excess energy during peak demand times. Despite V2G’s potential, high costs of bi-directional chargers and the complexity of managing shared credits pose implementation challenges. While some manufacturers are developing V2G-compatible cars, widespread adoption is still on the horizon.

The US energy sector, lacking incentives for energy buybacks, lags in this area compared to other regions, but the technology’s potential to generate revenue from stored energy keeps it on the radar for future fleet savings.

Conclusion: Data as the key to fleet electrification success

As fleet electrification progresses, data will be paramount for maximising cost-efficiency, ensuring regulatory compliance, and incentivising driver behaviours that favour sustainable, cost-saving practices.

The panel concluded that data will become a “valuable currency,” with technology continuing to simplify EV management for fleets as the industry adapts to evolving regulatory landscapes and environmental goals.