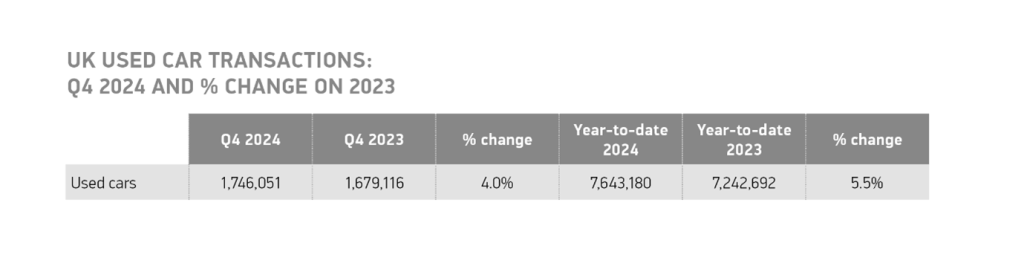

The UK’s used car market grew by 5.5% to 7,643,180 transactions in 2024, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT).

Marking eight quarters of continuous growth, the year saw 400,488 more vehicles change hands than in 2023, with growth in the new car market fuelling availability and wider choice within the used sector. Transactions rose in every month in 2024, as they did in 2023, with Q4 up 4.0% to 1,746,051 units.

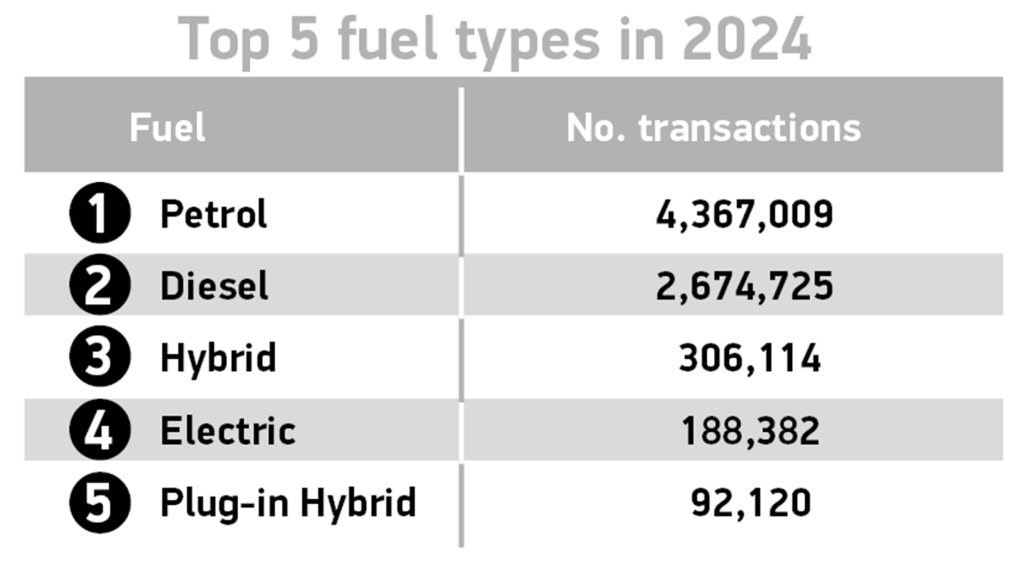

Demand continued to soar for used battery electric cars (BEVs), rising some 57.4% to a record 188,382 units and achieving a new high for market share, at 2.5%, up from 1.7% in 2023 and 13 times larger than back in 2019. BEV share in Q4 was 2.7%, matching Q3’s performance. Sales of plug-in hybrids (PHEVs) and hybrids (HEVs) also grew, up 32.2% to 92,120 units and 39.3% to 306,114 units respectively.

Combined, the number of used electrified vehicles changing hands increased by 43.3% on 2023, with more than half a million of these ultra low or zero emission motors accounting for a 7.7% share of sales. This growth aligns with the new car market and demonstrates the increasing demand and choice across the sector for new and used electric motors – at price points to suit all potential buyers.

However, according to the SMMT, such growth cannot continue to be taken for granted, especially given that from April, many BEVs registered in the new car market will be subject to Vehicle Excise Duty and the Expensive Car Supplement (ECS) – drastically increasing ownership costs during the first six years of a vehicle’s use and therefore likely to impact on the used market. Exempting BEVs from the ECS – or at least, raising the eligibility threshold, which has remained unchanged since 2017 – would therefore remove a substantial disincentive for both new and used buyers.

Petrol and diesel powered cars accounted for 92.1% of all used car transactions – down slightly from 94.3% last year. Petrol remained dominant, up 6.8% to represent 57.1% of the market, while diesel transactions dropped by -2.4%, accounting for 35.0% of all transactions.

Mike Hawes, SMMT Chief Executive, said, “The used car sector’s 25-month growth streak is good news for fleet renewal and for consumers benefitting from the greater choice filtering through from the new market.

“Record sales of second hand EVs also demonstrates strong appetite for these cutting-edge cars at lower price points,” Hawes noted.

He continued, “Ensuring ongoing growth, however, means maintaining that affordability, along with supply, which requires meaningful fiscal incentives to stimulate consumer demand for new EVs and removing the VED expensive car tax disincentive that risks dragging down used EV affordability for years to come.”

Matas Buzelis, car expert at vehicle history checking service carVertical, commented: “The used car market finished 2024 on a high with a 4% increase in sales year-on-year. It capped off an impressive year for the market, with demand from budget-conscious consumers leading to four consecutive quarters of growth in 2024. Over 7.5 million used cars have changed hands over the past 12 months, up 5.5% compared with 2023.

“The second-hand market remains a more attractive option for many car buyers, as household budgets are squeezed by persistent inflation and higher borrowing costs. This growing demand extends to second-hand EVs, which made up 2.5% of sales in the three months to December – a new record high.

“Many drivers remain hesitant to make the switch to electric, but increased supply is bringing average prices down and this is tempting more people into buying EVs and hybrids.

“The network of public charging points is also expanding quickly, providing reassurance to drivers that won’t run out of power while on the road.”